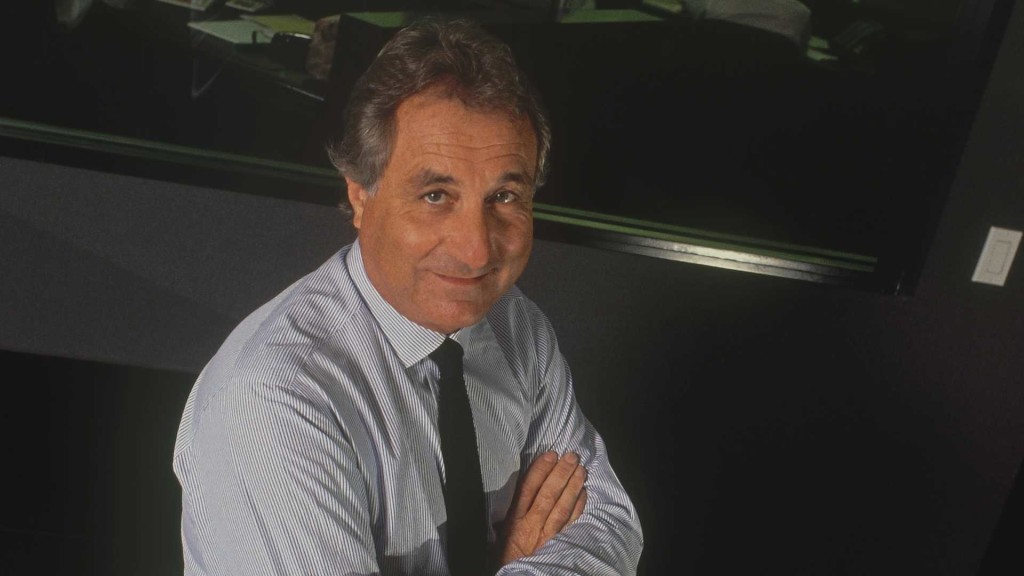

Peter Madoff Sentenced for Role in Brother’s Ponzi Scheme

December 21, 2012

Share

Peter Madoff was sentenced to 10 years in prison on Thursday for his role in the multi-billion dollar Ponzi scheme orchestrated by his older brother, Bernie.

Madoff, 67, is the second person to be sentenced in the wide-ranging fraud, which was first discovered four years ago this month. Bernie Madoff is currently serving a 150-year sentence at a federal prison in North Carolina.

“I am deeply ashamed of my conduct,” Peter Madoff said at his sentencing yesterday. “I accept full responsibility for my actions.”

In June, Madoff, who worked as chief compliance officer at his brother’s investment firm, pleaded guilty to multiple charges, including falsifying records, tax fraud and conspiracy to commit securities fraud.

“Peter Madoff was a gatekeeper, who was supposed to guard against fraud, but instead enabled it — facilitating his brother Bernie’s breathtaking scheme by falsifying compliance records and lying to both regulators and clients,” said U.S. Attorney Preet Bharara following the sentencing.

Madoff insisted he never knew about the Ponzi scheme, and claimed he first learned about it just 36 hours before his brother’s arrest — a claim that Judge Laura Taylor Swain said was “frankly, not believable.” Madoff was also ordered to surrender all of his assets, which have been valued at approximately $143 billion. The arrangement “seals Peter Madoff’s financial ruination,” Swain said.

Madoff’s clients suffered cash losses of about $17.3 billion in the fraud, according to Irving Picard, the bankruptcy trustee working to recoup those funds. To date, Picard has recovered $9.3 billion while an additional $2.35 billion has been seized by federal prosecutors.

The Madoff brothers remain the only members of their family to face criminal charges in connection to the fraud. Criminal charges have been filed, however, against an additional 12 defendants. Federal prosecutors have obtained guilty pleas from Frank DiPascali, who was Madoff’s chief financial officer, David Friehling, his former accountant, and five other former employees. Each are awaiting sentencing. Five other former employees have all pleaded not guilty and are awaiting trial.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting. Additional funding is provided by the Abrams Foundation; Park Foundation; the John D. and Catherine T. MacArthur Foundation; and the FRONTLINE Journalism Fund with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.