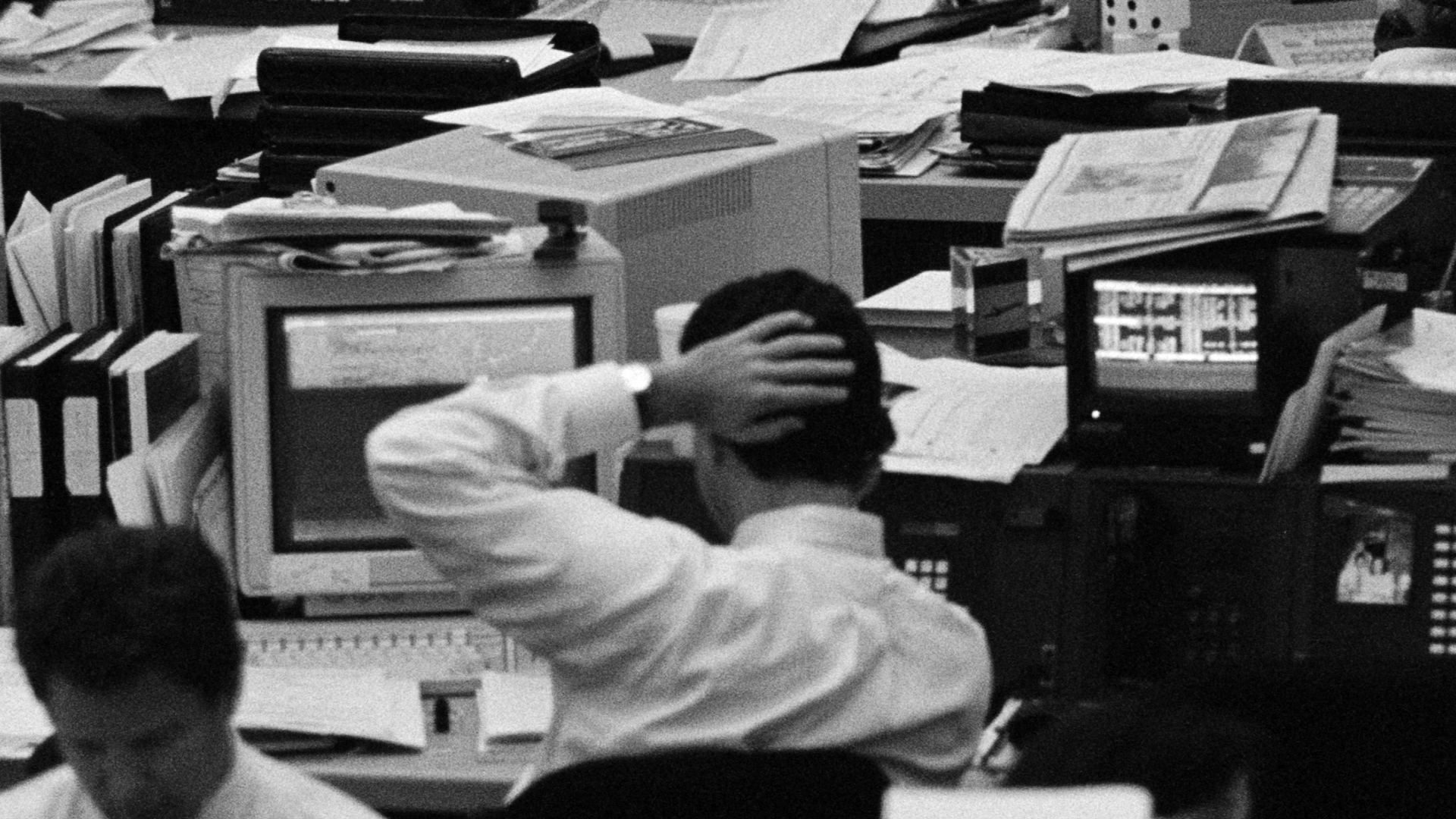

Survey: One in Four on Wall Street Open to Insider Trading

July 16, 2013

Share

If public confidence in Wall Street remains battered from the financial crisis, a new survey of ethics in the financial services industry is unlikely to help.

The survey, conducted by the law firm Labaton Sucharow, gauged the attitudes of 250 traders, portfolio managers, investment bankers, hedge fund professionals, financial analysts, investment advisers, asset managers and stock brokers across dozens of firms.

The results may not be scientific, but they provide a troubling glimpse of what many within the industry regard as commonplace misconduct.

According to the survey, 23 percent of industry insiders indicated “that they had observed or had firsthand knowledge of wrongdoing in the workplace.” Perhaps more concerning, 24 percent of respondents said they “likely would engage in insider trading to make $10 million if they could get away with it.”

The findings suggest many employees may feel compelled to misbehave. Nearly 30 percent of respondents believed they needed to engage in unethical or illegal activity in order to be successful. More than one-in-four believed compensation plans incentivized employees to either compromise ethical standards or violate the law. Meanwhile, close to 30 percent did not believe the industry puts the interests of clients first.

The trouble was most pronounced among the industry’s youngest employees. Among respondents with 10 years or less experience, 38 percent said they would engage in insider trading if they wouldn’t get arrested. Within that same group, 36 percent believed misconduct may be necessary to get ahead.

“Many of the young professionals who will one day assume control of the trillions of dollars that the industry manages have lost their moral compass, accepted corporate wrongdoing as a necessary evil and fear reporting misconduct,” the study warns. “This is a ticking economic time bomb that responsible organizations must immediately defuse.”

Many saw the trouble beginning in the corner office. Seventeen percent of respondents felt their leaders would look the other way if they suspected a top employee of insider trading. Another 15 percent doubted leadership would report it.

In terms of rank and file employees reporting misconduct, the study painted a mixed picture. In 2011, the Securities and Exchange Commission established a $500 million program that awards as much as 30 percent of any penalty collected in a whistle-blower suit to the whistleblower. While 89 percent of financial services professionals indicated a willingness to report wrongdoing, 40 percent were unaware of the SEC initiative.

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.