If time permits, read the

NewsHour article

, "How the Senate tax bill affects rich and poor, in three charts," which lays out the GOP tax plan in clear, easy-to-grasp terms.

Video Summary:

-

Republicans are working to push a new tax plan toward final passage after winning a procedural vote 52-48 on Wednesday to start debate on the Senate floor. The House of Representatives already passed their version of the GOP tax plan a couple of weeks ago.

-

The tax debate has fallen along party lines.

-

The majority of Republicans argue the GOP bill will be good for business. It cuts the corporate tax rate from 35 percent to 20 percent, which they say will attract more companies to stay and do business in the U.S. Republican lawmakers maintain that the government is too big and costs tax payers too much money.

-

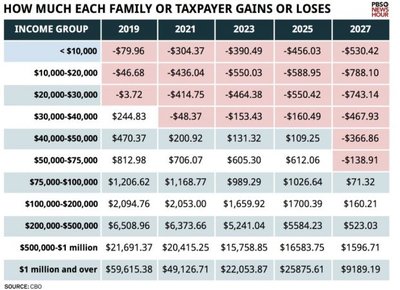

Democrats argue that the new tax plan will benefit the wealthiest of Americans and does not do nearly enough to help the middle-class. Democratic lawmakers say the bill raises taxes on low-income Americans within a few years time, and point to a Congressional Budget Office (

CBO

)

report

to support their argument.

-

Some Senate Republicans remain unsure about the bill. They fear it will increase the federal deficit and not do enough to help small businesses.

-

The bill impacts health care by removing the individual mandate, the requirement for individuals to sign up for coverage. According to the CBO, 13 million Americans would lose health care if the GOP tax bill is passed.

-

If the Senate passes their bill, both houses of Congress must agree on the same version of the bill before it goes to the president to sign.

Discussion questions:

-

Essential question

:

Why are taxes necessary in a democracy?

-

Why is support for a new federal tax plan divided along partisan (party) lines?

-

A good number of Americans believe the U.S. tax system is too progressive in that it moves too many resources from the rich to the poor. Do you agree or disagree? What evidence backs up your argument?

-

Media literacy question:

-

Democrat lawmakers tend to argue the poor needs the most help when it comes to getting on track with their lives. Meanwhile, Republican lawmakers often say poor Americans receive government benefits like Medicaid (health care for the poor) on top of paying little or no taxes.

-

Hearing such conflicting messages can be pretty draining and even confusing. What are some things you can do to find clarity on the issues you care about? Would you consider joining any civics organizations for young people? How about your student newspaper or student government? If you are feeling overwhelmed as a result of watching the news these days, be sure to talk with your parent or teacher or friends. Believe it or not, this is an important part of civic engagement.

Extension activity:

-

For an even deeper dive, take a look at

America's history with tax reform

through the years, starting back in 1776. What has led to its complicated history? Discuss some ways to make it a little

less

complicated with your peers.