How to Personalize the 50/30/20 Budget Rule for You and Your Familia

Welcome to the world of budgeting, where joy and responsible spending coexist harmoniously!

Is it possible to stay on budget and still enjoy your cafecitos and self-care rituals? The answer is a resounding sí!

We’re headed to Miami to meet Latina money expert Katia Chesnok, also known as Economikat, to break down the 50/30/20 rule and learn how to customize it to suit our own needs – even if budgeting feels scary at first.

“Budgeting is the foundation of a good financial life. But the word itself has an intimidating reputation because most of us were raised hearing ‘no hay dinero’ and believing that only wealthy people can maintain a budget,” Katia adds. “On the contrary, a budget created from an abundance mindset helps us control our money – instead of having our money control us.”

Tips from Katia for parents who want to start a budget:

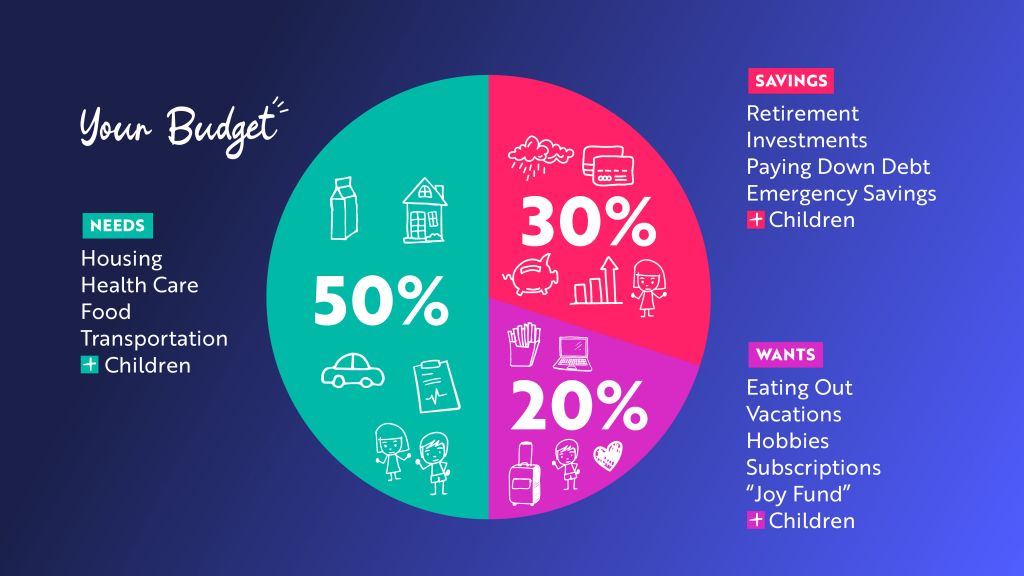

- There are many budgeting rules. Choose the ones that work for you and your family. As I always say, “Personal finance is personal.” But the 50/30/20 rule is a good place to start.

- Don’t be intimidated. With the tools you have at your disposal (pen and paper? or free budgeting apps?) – start now!

- Create a “Joy Fund” category in your budget. If you don’t allow for fun, shopping, travel, and entertainment, your budget won’t be sustainable.

- Create a “Kids Investing” category to help your kids get an early start on saving and investing. And, if you’re helping your parents, remember to include them in your budget too.

Host and producer Cindy Y. Rodriguez pulls back the curtain on her weekly dinero dates, offering a peek into her financial management while making sure she accounts for her “Joy Fund.”

Whether you’re a seasoned budgeting pro or just beginning your money journey, this episode is filled with insights that will guide you towards discovering your financial sweet spot.

Journal prompts:

Knowing Your Why: “Knowing your financial why is the first step to improving your finances,” Katia said. Ask yourself: Why do you want to start budgeting? Do you want to retire early? Help with your parents’ retirement? Or build generational wealth for your kids?

Balancing Joy and Budgeting: Reflect on how you perceive the relationship between budgeting and enjoying life’s pleasures. How can you strike a balance between spending and saving in a way that supports both your financial goals and your joy?

The 50/30/20 Rule: Consider how the 50/30/20 rule could align with your financial goals while maintaining space for self-care. Can you think of a way to personalize the 50/30/20 rule and make it work for your financial goals?

“Hay Dinero” is a five-part docuseries that provides practical financial planning tips for the Latinx community while shedding light on the connection between culture and generational trauma. Host Cindy Y. Rodriguez shares her wealth journey and interviews Latina leaders and money experts, who share practical tools and tips so you can shift your money mindset and get one step closer to building generational wealth.

To discover more programming for our Latinx community and to sign up for our mailing list, visit TRECE.

“Hay Dinero” is co-produced by RAVA FILMS and The WNET Group’s Chasing the Dream initiative.

The WNET Group is the parent organization of THIRTEEN, WLIW21, NJ Spotlight News, ALL ARTS and operator of NJ PBS – media made possible by all of you.

Chasing the Dream: Poverty and Opportunity in America is a multiplatform public media initiative reporting on poverty, justice, and economic opportunity, and showcasing promising solutions. Major funding for Chasing the Dream is provided by The JPB Foundation with additional funding from Sue and Edgar Wachenheim III.