- About the Financial Lab

- About

- Educator Guide

- Advisors

- Credits

About the Financial Lab

“Oh well guess you win some and lose some, as long as the outcome is income.” – Drake

When it comes to money, Drake’s not wrong: income is good. But what about the other half of the equation, the money that goes out (aka our spending)? That can be good too, when it buys us things we need or brings us happiness. But maintaining a healthy balance between the two – both now and in the future – can be really hard for most of us. We feel it in everything from small, daily choices like whether to go out for lunch, to bigger decisions like how to save for a car or pay for college. And even when we know what we should do, it can be surprisingly hard to actually do it.

Behavioral economists say we shouldn’t be too hard on ourselves, because the only thing we’re guilty of is being human. “We think, each of us, that we’re much more rational than we are,” says Nobel Prize winning psychologist Daniel Kahneman, who has compared our brain to “a machine for jumping to conclusions.” All too often, those conclusions lead us astray, no matter how smart or well-intentioned we might be.

While this sounds discouraging, don’t worry – you’ve come to the right place. For our latest NOVA Lab, we’ve teamed up with the Center for Advanced Hindsight at Duke University on a game designed to help students (and adults!) understand how we humans make financial decisions, and how to develop habits to overcome the behavioral biases that often get in our way. Think of it as a fun, safe place to practice managing your spending, paying off debts, and investing in your future. Here’s a quick preview of how the Financial Lab works:

Yanely Espinal

Players begin by watching an introductory video in which our wonderful host, financial educator Yanely Espinal, explores what we mean by financial wellness: “Basically, as long as you can pay for the things you need and some of the things you want, both today and in the future, then you’ve achieved it.” Pausing along the way to ask players to reflect on their own experiences with money, she then explains why it can be so hard to follow up on our intentions when we’re faced with financial decisions – because common behavioral biases tend to crop up when we think about money, whether we do it quickly and act on autopilot or deliberate more slowly over our choices.

Now players are ready to play the three mini-games we’ve designed to help them identify some key biases and practice strategies for overcoming them. After picking a pet that will come with them throughout the Lab – either Cash the Cat or Bones the Dog – they’ll be able to play the games multiple times and in any order to practice identifying their behavioral biases and developing better financial habits. We recommend playing in this order:

• In Shopportunity Cost, you’re getting ready to go to a concert – with your pet! But in order to sneak them in, you’ll need to make sure they pass as a human...which means you have some shopping to do. With each item you need to purchase comes a challenge: how to maximize your pet’s happiness while sticking to your budget. Because of our tendency to focus on the choice right in front of us – without considering the items we could buy with that money later – it’s harder than it sounds.

NOVA Labs

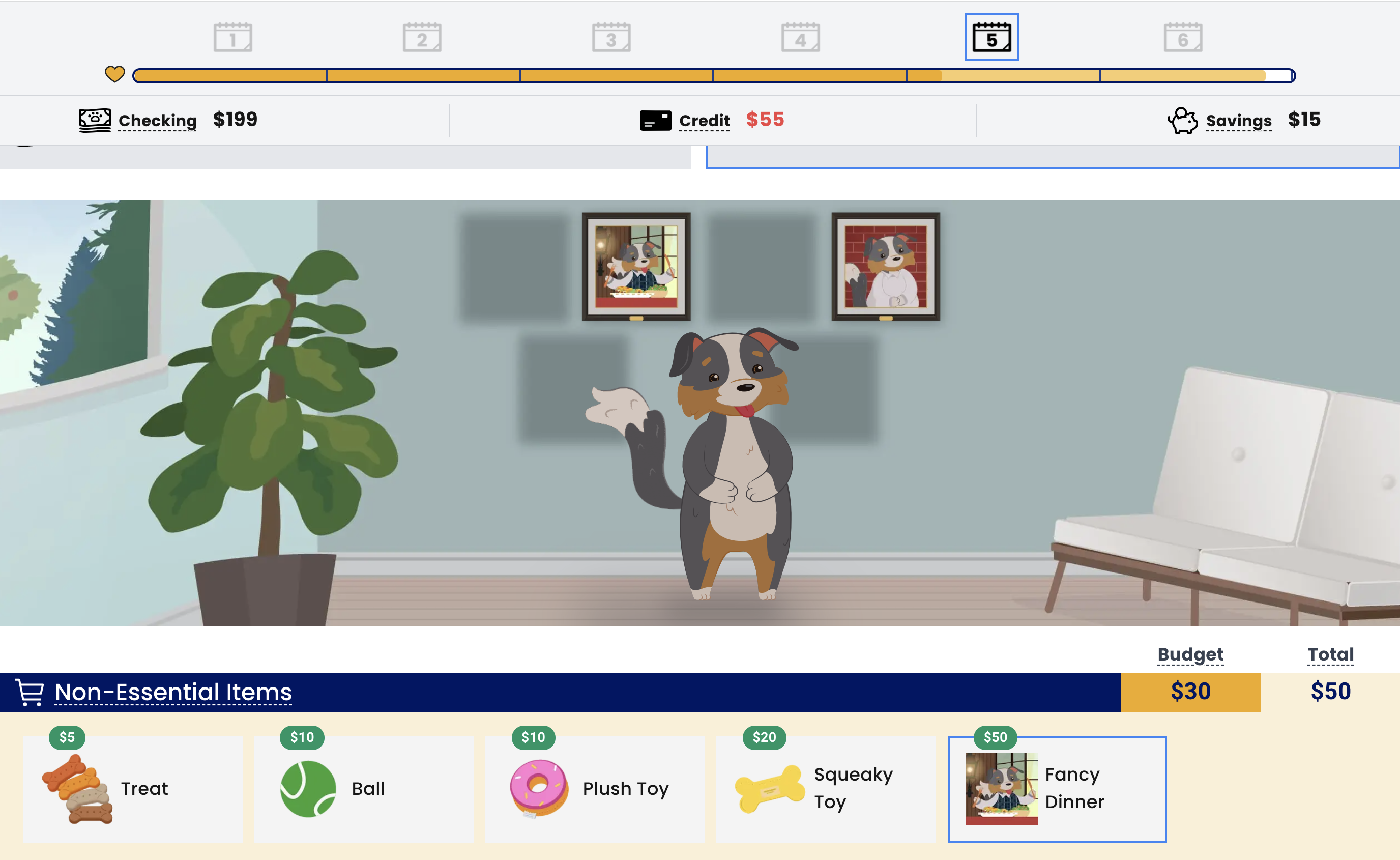

• In Budget Buster, your job is to take care of your pet, seeing to both its basic needs and overall happiness, for six months. To do it well, you must learn how to break your expenses down into useful “buckets” to help organize, evaluate, and track your spending. But don’t get too comfy: even the best plans should be adjusted when surprises, both good and bad, happen.

• In Exponential Potential, our game about longer term financial planning, your pet has taken a peek at the future and it’s not looking very good. Luckily, they have you and a time machine to help them decide how to pay off debts and make investments in order to maximize their net worth. Your success depends on your ability to master compound interest – a concept we humans struggle to comprehend – and make it your friend, not your enemy.

After each playthrough, players will earn a trophy for their pet and a tip for how to apply what they’ve learned to making financial decisions in real life.

Managing money is hard. There are many factors that are beyond your control, starting with the social and economic situation you’re born into. But when it comes to what you can control – your behavior – a little insight and practice overcoming the bad habits we have – and companies try to exploit – can really pay off.

So what are you waiting for? Go play the Financial Lab, and get to know your irrational side!