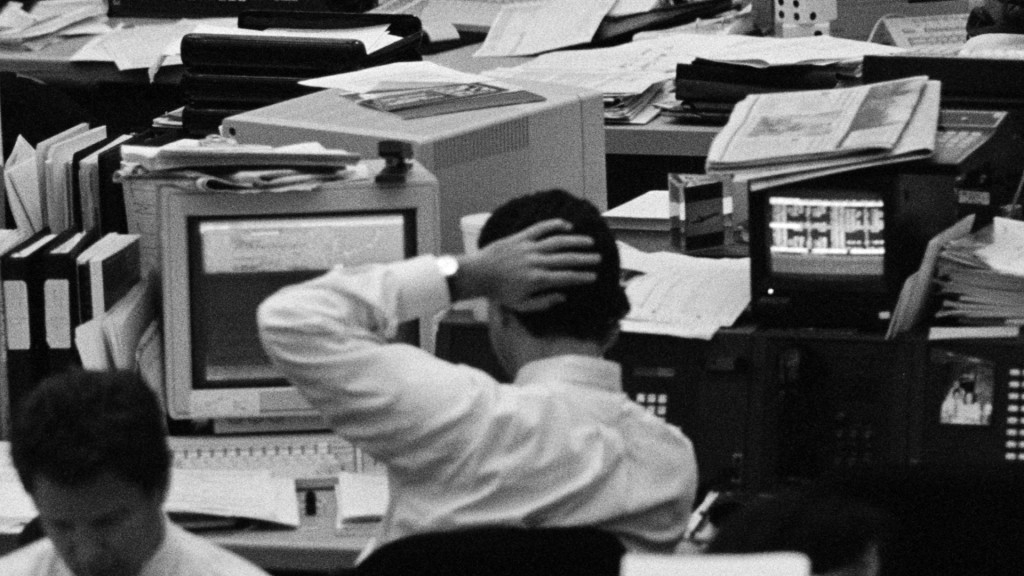

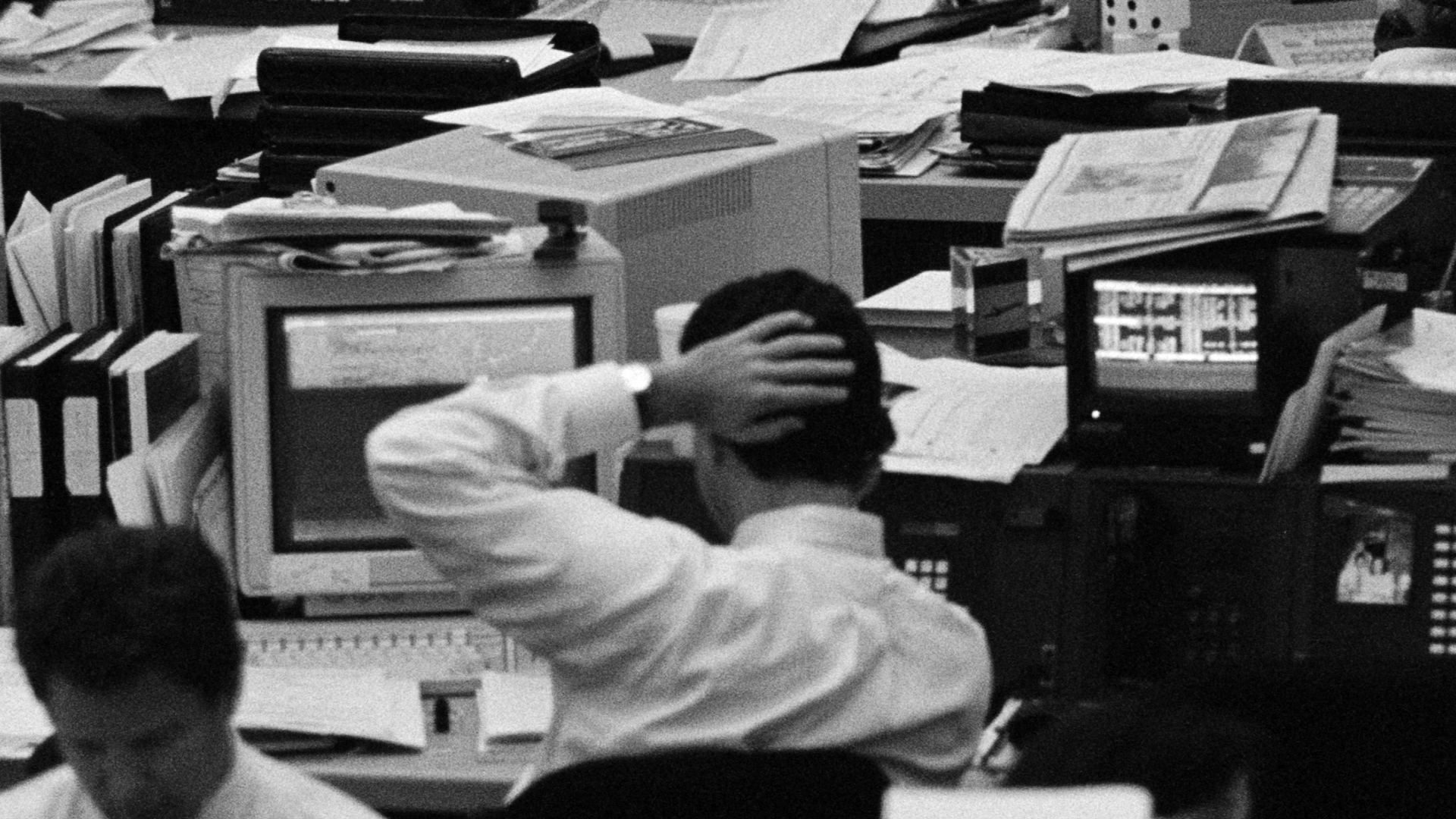

SAC Fund Manager Found Guilty in Insider Trading Case

December 18, 2013

Share

Michael Steinberg, the most senior employee yet to be tried in the government’s sweeping insider trading investigation into hedge fund SAC Capital Advisors, has been found guilty on five counts of securities fraud and conspiracy by a federal jury in Manhattan.

The verdict — delivered after less than two days of deliberations — comes only a month after SAC Capital pleaded guilty to fraud charges as part of a $1.8 billion deal to resolve a long-running insider trading probe that has embroiled the massive hedge fund and its billionaire founder, Steven A. Cohen.

In all, eight SAC employees have faced criminal charges. Six have pleaded guilty to securities fraud, and an eighth employee, Mathew Martoma, faces trial in January.

Steinberg, a 41-year-old portfolio manager, was accused of illegally trading stocks of the technology companies Dell and Nvidia after receiving confidential information about their earnings. The trades — which were said to generate profits of $1.4 million — are among those cited by the Securities and Exchange Commission in a separate civil case against Cohen, accusing him of failing to properly supervise his employees.

Last month, FRONTLINE published an exclusive video deposition in which the hedge fund titan described insider trading laws as vague and asked for an explanation of the SEC rule that prohibits such trading.

Today’s verdict represents one of the government’s most high-profile victories in its effort to stem insider trading on Wall Street. Since 2009, the United States attorney’s office in Manhattan has secured 76 convictions at trial without losing a case.

The government’s crackdown is the focus of next month’s FRONTLINE investigation, To Catch A Trader. The film premieres on-air and online Jan. 7. Watch a preview below.

Related Documentaries

Latest Documentaries

Related Stories

Related Stories

Explore

Policies

Teacher Center

Funding for FRONTLINE is provided through the support of PBS viewers and by the Corporation for Public Broadcasting, with major support from Ford Foundation. Additional funding is provided the Abrams Foundation, Park Foundation, John D. and Catherine T. MacArthur Foundation, Heising-Simons Foundation, and the FRONTLINE Trust, with major support from Jon and Jo Ann Hagler on behalf of the Jon L. Hagler Foundation, and additional support from Koo and Patricia Yuen. FRONTLINE is a registered trademark of WGBH Educational Foundation. Web Site Copyright ©1995-2025 WGBH Educational Foundation. PBS is a 501(c)(3) not-for-profit organization.