Explainer: Why Values Change Over Time

ROADSHOW talked to a cross-section of experts to learn more about the several key factors that can cause market values for antiques and collectibles to fluctuate over time.

Collectibles appraiser Travis Landry said the value of video games surged during the COVID-19 pandemic, but interest has fallen since. The value of these two video games, which Landry appraised for $3,000 to $5,000 in Santa Fe in 2022, has dropped to around $1,000 each today.

Jan 8, 2024

BY Sarah Roach

• Discretionary income always drives collecting markets

• Changing generational interests bring about shifts in collecting trends

• Auctions both reflect and affect trends in market interest

• Online buying and selling have increased access to and reduced rarity of antiques and collectibles

• Contemporary social issues tend to cultivate new markets

• Periods of economic downturn create opportunities for new buyers to enter the market

IN JUNE 2022, during ANTIQUES ROADSHOW’s tour stop in Santa Fe, collectibles appraiser Travis Landry gave two Nintendo games a combined auction estimate of $3,000 to $5,000.

At that time, the 1990 Super Mario Bros. 3 and 1988 Double Dragon games were at the top of their market. The COVID-19 pandemic had sparked increased interest in video games, and a grading company called Wata helped push that market to new heights, Landry noted. But when the episode aired the following year, he said the value of the Super Mario Bros. game had already fallen to around $1,200, while the Double Dragon game dropped to $1,000 to $1,500.

“People were getting into it so fast at the top end,” Landry explained. “Because of all these exponentially growing results, it led to uncertainty. People wondered if this is a real market…now prices have come down by 50%, if not more.”

Other markets are not so fickle; areas such as modernist design, books and manuscripts, and arms and militaria are relatively stable. But there are still several factors, like evolving cultural interests and record-setting auctions, that can often cause items to fluctuate in value over time.

We spoke with a handful of ROADSHOW appraisers across a range of categories to understand why items experience upswings and downswings in the market.

From collectibles to American folk art, here are a few common factors:

Discretionary income drives markets

Values change for two main reasons, according to Lark E. Mason, Jr., an auctioneer and appraiser who specializes in Asian art and who teaches a course on the topic for appraisers to receive professional accreditation.

First, and perhaps most obviously, the discretionary resources potential buyers have to spend on antiques and collectibles fluctuates in cycles as the larger economy strengthens or weakens. Second, broadly speaking, tastes and trends in all kinds of goods and products also evolve over time.

“We don’t need art to live — it is purchased after all the necessities are taken care of,” Mason said. “During times of economic hardship and uncertainty the tiers of the market that are affected the most are the lower economic tier of consumers, then the middle market tier, and the least affected are the upper tier.”

Mason said during a booming economy, the middle tier drives the market because they have more discretionary income and are a relatively large demographic. The most wealthy, on the other hand, are not driven only by discretionary money. This class is more likely to spend cash because of emotional reasons, such as buying an artist’s work because they like the subject matter, or practical reasons, like replacing a piece of silver because their existing piece broke.

Today, Mason said some areas of collecting have declined because of a tight economy and waning interest. He said traditional American and European furniture and decorative arts, for instance, have less appeal because people generally lack discretionary money to spend on it, and wealthy buyers who could purchase those items aren’t emotionally drawn to it.

Generational interests shift collecting trends

Many markets are also propelled by the forces of shifting generational interests. “Every generation has a different priority from the prior generation or the generation that follows,” Mason said.

Arms and militaria appraiser Jeff Shrader said the market peaks “when the majority of people with that particular nostalgic connection are in their prime earning and spending years.” When one generation ages and their collections hit the market, new buyers may be less inclined to purchase that material.

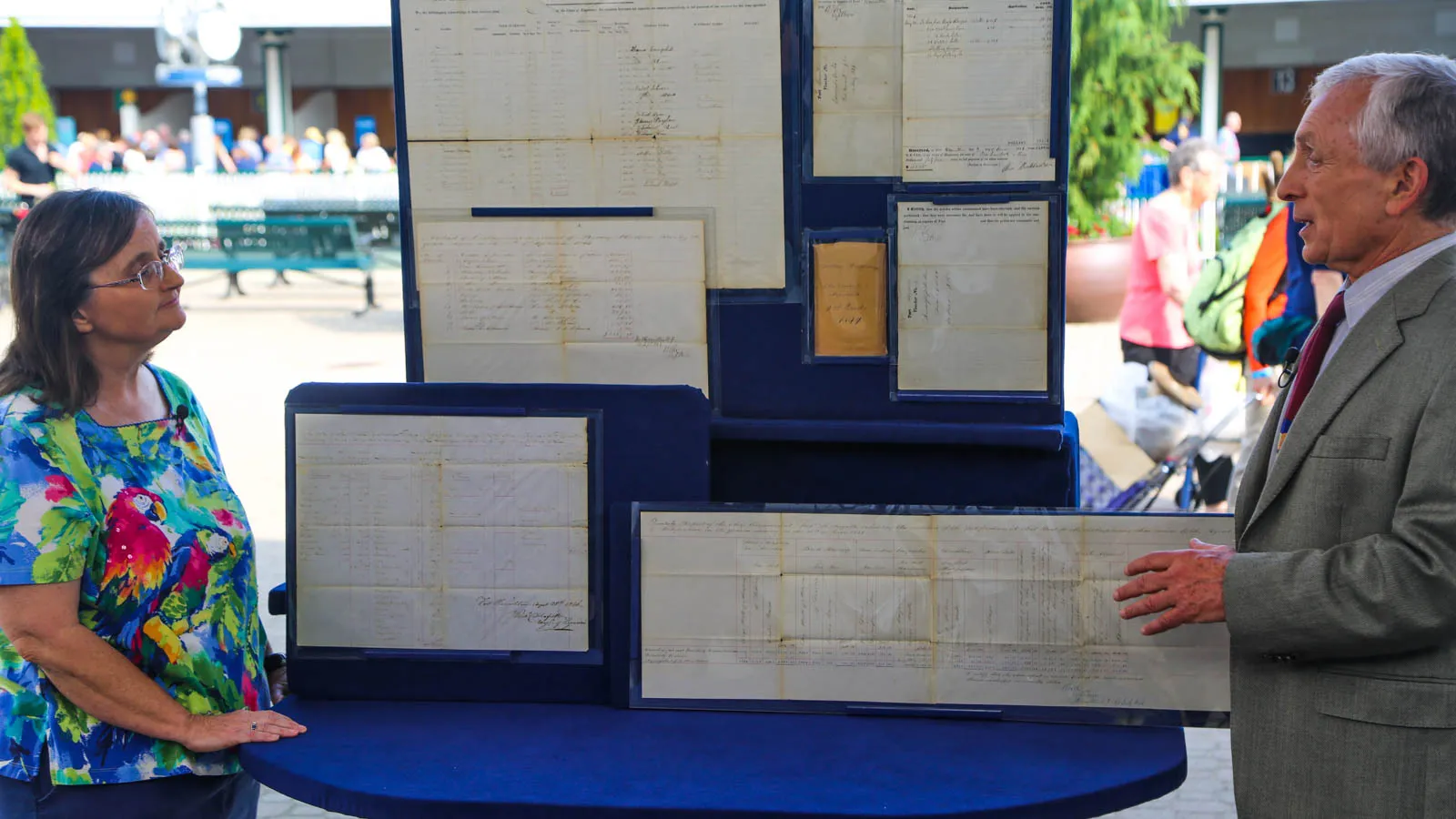

During ROADSHOW's 2022 show in Boise, Idaho, Arms & Militaria appraiser Jeff Shrader gave this Civil War Union officer's group a retail value of $10,000. Shrader says interest in Civil War material waned after the 2008 recession, mainly because the previous high prices were driven by investors flush with cash, rather than by passionate "pure" collectors.

But Shrader said arms and militaria aren’t as affected by generational waves. “The thing that drives a great many of the militaria collectors is the compelling nature of the history represented by the artifacts,” Shrader said. “You don't need to have been around in the 1930s, listening to stories shared by the last surviving Civil War veterans, to become hooked on that history.”

Militaria isn’t entirely immune to downturns either; Shrader said people stopped buying Civil War material after the 2008 recession, mainly because the previous high prices were driven by wealthy investors rather than pure collectors. These investors became more cash-strapped after the recession and stopped buying Civil War memorabilia.

Auctions both reflect and affect changing market interests

Auctions are often evidence of changing interests, according to Allan Katz, a dealer and appraiser of American folk art. If a piece brought $15,000 at auction where the last one sold for $3,000, for example, it indicates growing interest in that work from collectors.

Katz added that the creation of auction houses also sometimes creates new markets. In 2004, for example, Katz appraised a John Alexander stoneware cooler for a retail value of $65,000 to $85,000. Stoneware has done exceedingly well since that appraisal, in part because the auction house Crocker Farm began auctioning stoneware and redware in 2004. Crocker Farm holds an auction of stoneware and redware every spring, summer, and fall.

Allan Katz, a dealer and appraiser of American folk art, said he would appraise this stoneware cooler from 2004 for a retail price of about $175,000, more than double its original estimate today, in part because of the creation of an auction house in 2004 that focuses on stoneware. He said that auction house has helped drive up prices in the stoneware market.

Today, Katz said he would appraise that same cooler for a retail price of about $175,000.

Auctions may also reflect increased interest in an artist by museums and collectors. A piece of glazed stoneware made in 1985 by the late Japanese-American ceramic artist Toshiko Takaezu, for example, was consigned to auction earlier this year with a $20,000 to $30,000 estimate. The round stoneware titled “Moon” sold for $540,000 in April.

Auctioneer and appraiser David Rago, who specializes in 19th and 20th century furniture and art pottery, said museums and collectors had shown growing interest in Takaezu’s work for some time before the auction. The Venice Biennale – a prestigious international arts exhibition – held a showing of Takaezu’s ceramic sculptures in 2022. Additional shows were also lined up at the Museum of Fine Art and Noguchi Museum in New York.

Rago said these specialty events focused on Takaezu created a “recipe for an explosion” in terms of interest in her work. “These are the sort of things that make markets happen.”

Online buying and selling have increased access, reduced perceived rarity

Books and manuscripts appraisers said the rise of online selling significantly altered the marketplace. Books that were once considered rare became increasingly easy to find, causing the value of many secondhand books to drop.

“You’d go into a bookstore … and you’d see a book and you’d say, ‘Gee, that’s a lot of money, but I know I want it and when am I ever going to find another one? If I don’t buy it now … I might never get it,’” appraiser and antiques book dealer Ken Gloss said, referring to a time before the rise of e-commerce. “You tend to buy it. But then the internet showed that they weren’t really rare. They were just hard to find.”

Books appraiser Devon Eastland said the market for first-edition books “never really recovered” after the advent of the internet because they became so easily findable. Eastland said many of her clients in the late 1990s and early 2000s turned down her book offers because they could find a cheaper copy online. “After I figured this out, I started searching before I quoted the book, and sometimes ended up buying the other copy myself, to get it off the market,” she explained.

Appraiser and antiques book dealer Ken Gloss said interest in material tied to racist or anti-Semitic historical figures has declined. The value of these documents signed by Confederate general Robert E. Lee, which Gloss appraised for $14,000 to $21,000 in 2017, has dropped by about a half or a third of that price today.

Eastland added that values often shrink when a specific market is flooded with the same book or category of books. These changes affect how auctions are run. Eastland said if a first-edition Hemingway novel with a solid dust jacket sold for $800 to $1,200, she would avoid placing multiple copies in the same sale to protect that strong initial sale.

Social issues cultivate new markets

The push to highlight historically underrepresented material has also fostered growth in certain collecting fields. In the books market, for instance, Eastland said there’s a shift toward collecting material that supports a deeper understanding of history that includes women, the Black experience in the U.S., and other issues or groups of people.

Auction houses have helped foster this growth. Swann Galleries created a department dedicated to African American Art and regularly holds sales focused on female and LGBTQ+ material. Eastland said this shift in attention toward historically underrepresented topics has increased the value of material related to those topics.

On the other hand, Gloss said interest in material related to racist or anti-Semitic historical figures has fallen. In 2017, Gloss appraised documents signed by Robert E. Lee, the head general of the Confederacy, for $14,000 to $21,000. Today, however, Gloss said he would only appraise those documents for about a half or a third of that price.

Katz said the same trend holds true in American folk art. “Fewer collectors pursuing these objects translates to lower valuation,” Katz said, referring to racially offensive material.

Downturns create new buyers

Most appraisers agreed that decreases in value aren’t necessarily a bad thing. Katz said many areas of American folk are down right now, but that’s merely the “cycle that takes place.”

He said these low points in the market create new opportunities for first-time buyers to step in and pursue their collecting interests. “Prices go down. New collectors can now come on board,” Katz said, adding that buyers should proceed with caution when they’re looking to buy an item during a downturn. “The Wall Street expression is ‘don’t try to catch a falling knife.’”

But Katz said now is a safer time to collect because markets are less unsure. “I think the market has bottomed and markets are more predictable now … after the pandemic and recession, we’d sit there at the folk art table and say ‘I don’t know what this is worth’ because prices were going down. Now it’s become much more stable.”

Sarah Roach is ANTIQUES ROADSHOW's digital associate producer/editor. She has been a producer with the series since 2022.