NJ Spotlight News

Advocates:End of CBT surcharge is tax break for corporations

Clip: 11/30/2023 | 4m 31sVideo has Closed Captions

Some want to make the 2.5% surcharge permanent

Dec. 31 is the last day that New Jersey will charge a 2.5% surcharge on the state's corporate business tax, ending a revenue stream as the state faces new fiscal challenges. But progressive groups say the money brought in by the surcharge is urgently needed to fund NJ Transit and all of the benefits that a strong transit system provides.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

NJ Spotlight News is a local public television program presented by THIRTEEN PBS

NJ Spotlight News

Advocates:End of CBT surcharge is tax break for corporations

Clip: 11/30/2023 | 4m 31sVideo has Closed Captions

Dec. 31 is the last day that New Jersey will charge a 2.5% surcharge on the state's corporate business tax, ending a revenue stream as the state faces new fiscal challenges. But progressive groups say the money brought in by the surcharge is urgently needed to fund NJ Transit and all of the benefits that a strong transit system provides.

Problems playing video? | Closed Captioning Feedback

How to Watch NJ Spotlight News

NJ Spotlight News is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipIn our spotlight on Business Report tonight, the state's corporate business tax surcharge isn't going to expire without a fight.

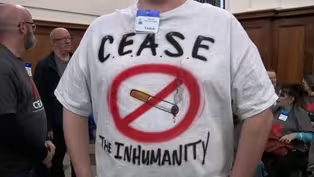

A number of progressive groups today rallied outside the statehouse in Trenton, asking lawmakers to make a last ditch effort that will keep the two and a half percent surcharge alive before it sunsets at the end of the year.

They see it as the equivalent of cutting a massive check to some of the state's most profitable businesses.

But Governor Murphy, he's not budging.

Senior correspondent Joanna Gagis reports.

Pay up.

Amazon pay up Amazon.

Several organizations that make up the coalition For the Many gathered outside the statehouse annex today demanding that Governor Murphy reversed course on letting the corporate business tax surcharge sunset at the end of this legislative session.

We are here to say and to urge that lawmakers and the governor make sure that we do not give the largest corporations in our state a $1 billion tax cut on the backs of working people in our state.

The tax surcharge was enacted in 2018 and increases the tax on businesses whose net profit is more than $1,000,000.

It was extended during the COVID 19 pandemic, but Governor Murphy promised to let it expire at the end of this year.

These corporations have committed to invest more here and create more jobs.

I think a deal's a deal.

But these groups cry foul on that deal.

Why is it that the deal that we are caring about is a deal with the world's largest corporations and not just New Jersey corporations?

These are corporations, multinational corporations that happen to do business in New Jersey that make money off of us.

Why is the deal with them the one that counts?

What about the deal with New Jersey's commuters and the people who use transit every day to get to work, to get to doctor's appointments, to get to school?

They're calling for this tax to be renewed and to be allocated as a permanent funding source for NJ Transit, which is facing a $1 billion budget hole next year.

Some lawmakers, like Paul Sarlo, chair of the Senate Budget Committee, are calling for a dedicated funding source to keep the agency from falling off that fiscal cliff.

The governor, addressing NJ Transit today, said.

All options on NJ Transit are on the table.

It's a work in progress.

It's not hanging over our head tomorrow.

So this is really a fiscal.

This is really two years from now.

Why are we writing $1,000,000,000 check to ExxonMobil instead of writing $1,000,000,000 check to New Jersey Transit.

Or to a number of other social support programs that these advocates say would help struggling working families?

We see firsthand that trickle down economics.

It doesn't work.

There are too many families in crisis here in New Jersey.

And we need to assist and invest in our communities and in our families.

And we need long term sustainable funding for things like affordable housing and rental assistance to expand the child tax credit and more.

And you know what we don't need?

Who doesn't need our help?

Our wealthiest corporations like Amazon, Walmart, Bank of America, you know, they're taking they're taking the money and they're going to run.

This is not small business.

This is not mom and pop.

This is not a pizzeria.

Yet still, business and industry organizations have applauded the surcharge sunsetting, saying it'll be good for the state's business climate.

But as for whether increasing the surcharge could drive businesses out of New Jersey, Maura Collinsgru from NJ Policy perspective says no.

There's no evidence of that whatsoever, as a matter of fact.

Choose New Jersey, which has issued report after report, has talked about the number of companies coming to New Jersey.

And so, you know, this is nothing that has, you know, discourage business.

They are making record profits and there is really no reason to let this sunset.

The groups here with for the many say that even if this corporate business tax surcharge does expire at the end of this legislative session, they're going to pick back up with this work to fight to get it renewed at the beginning of the next legislative session in Trenton.

I'm Joanna Gagis.

NJ Spotlight News.

Support for the business report is provided by Newark Alliance, which curates the Newark Holiday Festival.

A collaborative calendar of holiday events in Newark's Arts and Education District.

More details available at Newark Holiday Festival dot com.

Bergen County man arrested for assault in Jersey City bar

Video has Closed Captions

Clip: 11/30/2023 | 1m 20s | Victim claims it was a hate crime (1m 20s)

Casino smoking ban vote delayed after heated debated

Video has Closed Captions

Clip: 11/30/2023 | 3m 52s | Another hearing could be scheduled in December (3m 52s)

A closer look at the corporation-business tax surcharge

Video has Closed Captions

Clip: 11/30/2023 | 3m 59s | What is NJ's corporate business tax surcharge? (3m 59s)

Gun owners see little value in securing firearms, new report

Video has Closed Captions

Clip: 11/30/2023 | 4m 14s | Interview: Mike Anestis, executive director of New Jersey Gun Violence Research Center (4m 14s)

Murphy: $15 congestion pricing toll, 'unfair'

Video has Closed Captions

Clip: 11/30/2023 | 4m 54s | 'It’s ripping off NJ commuters to pay for whatever financial failings the MTA has' (4m 54s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

NJ Spotlight News is a local public television program presented by THIRTEEN PBS