Chicago Tonight: Latino Voices

Illinois Leads US in Applications for Student Debt Relief

Clip: 3/18/2023 | 6m 55sVideo has Closed Captions

What's at stake as the U.S. Supreme Court debates the future of student loan forgiveness.

Many Latino borrowers could benefit from President Joe Biden's student loan forgiveness plan. Latinos are more likely to default on their student loans than White students, and 67% of Latino student borrowers have educational debt.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Chicago Tonight: Latino Voices is a local public television program presented by WTTW

Chicago Tonight: Latino Voices

Illinois Leads US in Applications for Student Debt Relief

Clip: 3/18/2023 | 6m 55sVideo has Closed Captions

Many Latino borrowers could benefit from President Joe Biden's student loan forgiveness plan. Latinos are more likely to default on their student loans than White students, and 67% of Latino student borrowers have educational debt.

Problems playing video? | Closed Captioning Feedback

How to Watch Chicago Tonight: Latino Voices

Chicago Tonight: Latino Voices is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship>> THE STATE OF ILLINOIS LEADS THE NATION IN APPLICATIONS FOR STUDENT LOAN DEBT RELIEF.

MORE THAN 1.5 MILLION RESIDENTS APPLIED FOR LOAN FORGIVENESS BEFORE THE PLAN WAS PUT ON HOLD AND THE CHALLENGES.

THE PLAN IS NOW IN THE HANDS OF THE SUPREME COURT WHICH USHERED ARGUMENTS.

IF UPHELD , MILLIONS OF BORROWERS ACROSS THE COUNTRY WOULD BENEFIT , INCLUDING LATINOS.

67% OF LATINOS HAVE EDUCATIONAL DEBT.

BECAUSE OF THAT , 33% PUT OFF GETTING MARRIED.

37% REPORT WAITING LONGER TO HAVE CHILDREN.

LATINOS ARE ALSO MORE LIKELY TO DEFAULT FROM THEIR STUDENT LOAN THAN WHITES.

JOINING US TO TALK ABOUT THIS, THE PRESIDENT AND CEO OF THE WOODSTOCK INSTITUTE.

THANK YOU FOR BEING HERE .

ACCORDING TO THE U.S. DEPARTMENT OF EDUCATION DATA , ILLINOIS LEADS THE NATION IN APPLICATIONS FOR STUDENT DEBT RELIEF.

IT IS ALSO NUMBER SEVEN IN THE NATION FOR OUTSTANDING STUDENT DEBT.

DO YOU THINK THOSE NUMBERS TELL US ANYTHING ABOUT THE STATE OF ILLINOIS?

>> IT TELLS US A COUPLE OF DIFFERENT THINGS.

SOME GOOD AND SOME BAD.

FIRST AND FOREMOST, WITH REGARD TO THE EFFORTS BY THE NONPROFIT IN ILLINOIS TO GET THE WORD OUT.

PARTNERSHIPS WITH THE EDUCATION SYSTEM, COLLEGES BEING FORWARD IN MAKING SURE THAT PEOPLE KNOW WHAT THEIR RIGHTS ARE.

I HAVE TRAVELED QUITE A BIT.

I MOVED HERE A COUPLE YEARS AGO FROM CALIFORNIA.

I NOTICED MUCH MORE EFFORT IN ILLINOIS IN KEEPING PEOPLE EDUCATED ABOUT THIS.

THAT IS A POSITIVE.

WITH REGARD TO THE NUMBERS ON THE IMPACT ON LATINOS, WE HAVE A VERY STRONG CULTURE AS IT RELATES TO MONEY AND DEBT.

THAT HAS WORKED IN OUR FAVOR IN BORROWING FOR QUITE SOME TIME.

IT MAY TAKE LONGER THE DIFFICULT BALANCE BETWEEN WORK AND SCHOOL , BUT 67% OF LATINO COLLEGE STUDENTS GOT STUDENT LOANS, COMPARED TO 76% OF BLACK STUDENTS.

THE AVERAGE AMOUNT OF DEBT WAS $24,000 FOR LATINOS COMPARED TO $32,000 FOR BLACK STUDENTS.

THE PERCENTAGE OF ADULT STUDENT LOAN DEBT WAS LOWER FOR LATINOS, 14%, COMPARED TO BLACK AT 30% AND WHITE ADULTS AT 20%.

THE TREND IS NOT GREAT.

WE NEED TO WATCH THAT.

THE SHEER VOLUME OF DEBT IS GROWING REALLY FAST .

FOR LATINOS , FROM 20,005 TO 2016, HAS GROWN.

IT IS A SYSTEMIC ISSUE .

>> WHAT BARRIERS TO FINANCING THEIR EDUCATION DO STUDENTS YOU WORK WITH FACE ?

>> THANK YOU SO MUCH FOR HAVING ME.

THERE ARE A NUMBER OF BARRIERS OUR STUDENTS ARE FACING WHEN IT COMES TO ACCESSING CRITICAL MONEY THEY NEED FOR EDUCATION.

FIRST AND FOREMOST, THE PROCESS ITSELF IS PRETTY ROBUST.

AND SOME OF OUR STUDENTS ARE LACKING THE CRITICAL GUIDANCE AND SUPPORT FROM THE SCHOOLS AND IN THE COMMUNITY TO UNDERSTAND THE FINANCIAL AID PROCESS.

REALLY, HAVE THE FINANCIAL KNOWLEDGE THEY NEED TO MAKE CRITICAL DECISIONS ABOUT GOING TO SCHOOL.

>> WE HEARD IN THE INTERIM THAT LATINOS WITH STUDENT DEBT ARE MAKING THE DECISIONS WITH THEIR STUDENT DEBT IN MIND.

WHAT KIND OF AN EFFECT OF STUDENT DEBT HAS ON BUILDING WEALTH FOR LATINOS ?

>> WHEN YOU THINK ABOUT THE SYSTEMIC INEQUITIES PEOPLE HAVE TO DO WITH, WEALTH AND INCOME GAP , BARRIERS THEY ARE FACING IN TERMS OF HOMEOWNERSHIP, STARTING A BUSINESS, IT WASN'T LONG AGO THAT THE BURDEN OF EDUCATION WAS THE GOVERNMENT INVESTING IN YOUNG PEOPLE IN THE COMMUNITIES.

THAT BURDEN HAS TRANSITIONED TO FAMILIES AND INDIVIDUALS , MAKING IT EVEN HARDER THAN IT ALREADY WAS TO BREAK PATHWAYS TO HOMEOWNERSHIP.

>> HOW DOES THIS WORK WITH STUDENTS TO MINIMIZE EDUCATIONAL DEBT?

>> I THINK OUR FIRST APPROACH IS REALLY JUST IN SUPPORTING STUDENTS AND THE FAMILIES IN BUILDING FINANCIAL KNOWLEDGE THEY NEED TO UNDERSTAND THE SYSTEM.

AND HAVE A FULL UNDERSTANDING OF THE IMPACT THIS IS GOING TO HAVE ON THEIR FINANCIAL FUTURE.

WE TAKE A TWO-TIERED APPROACH.

WE ARE PROACTIVE AND WORK WITH STUDENTS WHO ARE IN HIGH SCHOOL AND PREPARING TO THE COLLEGE CHOICE , TO UNDERSTAND WHAT THEIR OPTIONS ARE.

WITH PUBLIC DISCOURSE ON LOANS, THEIR EYES -- THERE IS A LOT OF FEAR REGARDING STUDENT LOANS .

OUR ROLE IS TO ENSURE THAT THEY UNDERSTAND WHICH INSTITUTIONS ARE THE BEST FOR THEM, FINANCIALLY, AND ARE IN LINE WITH THEIR ACADEMIC AND CAREER GOALS.

THE NEXT STEP IS SUPPORTING STUDENTS WHEN THEY ARE ALREADY IN COLLEGE.

IN A PROLONGED EFFORT, FINANCIAL BARRIERS CONTINUE TO COME UP WITHIN A STUDENT'S EDUCATIONAL CAREER.

SO , WE WORK WITH STUDENTS ONE ON ONE TO MAKE SURE THEY HAVE A PLAN TO PAY FOR SCHOOL IN A WAY THAT REDUCES DEBT AS MUCH AS POSSIBLE.

>> WE ARE CUTTING IT SHORT ON TIME.

LAST QUESTION, HOW DO YOU THINK THE U.S.

COMPARES TO OTHER NATIONS IN THE APPROACH OF PAYING OFF STUDENT DEBT , STUDENT LOAN DEBT?

>> DEPENDING ON HOW SHORT A TIME YOU HAVE, NOT WELL.

IF YOU TAKE AN HONEST LOOK AT WHAT THE UNITED STATES IS DOING, THE INCOME , SOCIAL SECURITY, IT BOILS DOWN TO AN EDUCATION WORKFORCE.

WE NEED TO RECALIBRATE AND HAVE THE SAME CONVERSATION WE DID IN THE 1800s WHEN WE CAME TO THE SAME CONCLUSION , EDUCATION

Chef Mark Mendez on the Seriousness of Latin Cuisine

Video has Closed Captions

Clip: 3/18/2023 | 3m 31s | Hear from Chef Mark Mendez in our On the Pass series. (3m 31s)

Illinois Workers Will Soon Be Guaranteed Paid Leave

Video has Closed Captions

Clip: 3/18/2023 | 7m 28s | The law goes into effect next year. One hour of paid leave is earned per 40 hours worked. (7m 28s)

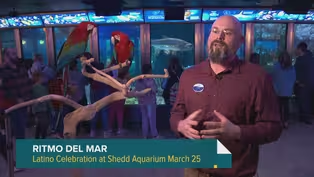

Ritmo del Mar Brings Latin Music, Culture to Shedd Aquarium

Video has Closed Captions

Clip: 3/18/2023 | 1m 48s | Enjoy the sabor of the sea at an upcoming event at the Shedd Aquarium. (1m 48s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

Chicago Tonight: Latino Voices is a local public television program presented by WTTW