Child poverty increases sharply after tax credit expiration

Clip: 9/12/2023 | 6m 11sVideo has Closed Captions

Child poverty increases sharply following expiration of expanded tax credit

In 2021, as the economy reeled from the pandemic, a one-year expansion of the child tax credit led to a historic 46 percent decline in the child poverty rate. But new census data shows a dramatic reversal with the rate of children in poverty skyrocketing in 2022. Experts say it’s due to the end of pandemic-era safety net policies and inflation. Stephanie Sy discussed more with Catherine Rampell.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...

Child poverty increases sharply after tax credit expiration

Clip: 9/12/2023 | 6m 11sVideo has Closed Captions

In 2021, as the economy reeled from the pandemic, a one-year expansion of the child tax credit led to a historic 46 percent decline in the child poverty rate. But new census data shows a dramatic reversal with the rate of children in poverty skyrocketing in 2022. Experts say it’s due to the end of pandemic-era safety net policies and inflation. Stephanie Sy discussed more with Catherine Rampell.

Problems playing video? | Closed Captioning Feedback

How to Watch PBS News Hour

PBS News Hour is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipAMNA NAWAZ: The child poverty rate in the U.S. has more than doubled just a year after dropping to historic lows.

Stephanie Sy takes a look at new census data out today and what led to this increase.

STEPHANIE SY: Back in 2021, as the economy reeled from the pandemic, a one-year expansion of the child tax credit led to a historic 46 percent decline in the U.S. child poverty rate.

It dropped from 9.7 percent to 5.2 percent.

New census data out today shows a dramatic reversal, with the rate of children in poverty skyrocketing to 12.4 percent in 2022.

That's higher than pre-pandemic levels.

To help us understand what's behind the numbers, I'm joined by Catherine Rampell, a "NewsHour" special correspondent and columnist at The Washington Post.

Catherine, it's good to see you.

We are talking about the largest one-year jump on record for what's called the supplemental poverty rate.

That includes the value of government benefits.

Were you expecting this big of a spike?

And what kind of hardships does this translate into for the five million more children now in this category?

CATHERINE RAMPELL: I think most people who follow this issue were expecting some increase in the number of children who had fallen into poverty or maybe were pushed into poverty, depending on how you look at it.

But these numbers are astounding, I think, more than double the child poverty rate in 2022 that we saw in 2021, a result partly, of course, of the fact that cost of living has gone up.

Some of the expenses that are taken into account in that measure, work expenses, medical expenses, et cetera, have gone up.

But, primarily, it is due to a policy choice that lawmakers made, which was to basically let a number of pandemic-era programs lapse, chiefly the child tax credit, as you mentioned, but some others as well.

STEPHANIE SY: What does this mean for families and children?

I know that some food pantries are -- reported last year that they did see a rise in the number of people, for example, seeking food assistance.

CATHERINE RAMPELL: Absolutely.

So, if you look at a number of surveys collected by the Census Bureau, as well as other government institutions, the implementation of that expanded child tax credit or child allowance was associated with a significant decline in measures of food insecurity, financial insecurity, whether people could pay sudden bills, for example.

And, as you might expect, when that support disappeared, you saw the reverse.

You saw greater need for food assistance, whether it's from food pantries or otherwise.

Other signs of financial hardship rose as a result of that program being taken away.

And if you look, in fact, at the surveys conducted over how people had been spending those funds, because the Census Bureau had been collecting data on that, it showed that parents primarily reported using the child tax credit dollars on things like basic household necessities, rent, childcare, school supplies, groceries.

So, again, when that support was taken away, you saw those kinds of hardships return to what they had been before the pandemic, in fact, higher than they had been before the pandemic.

STEPHANIE SY: Yes, and not to mention that we had 9 percent inflation in certain months last year for basic essentials.

As you write in your Washington Post column today, Catherine, the reason the Biden policy packed such a -- quote -- "powerful poverty-fighting punch" is that it was not conditional on any minimal level of income or earnings.

Why does unconditional cash assistance have a different impact, in your view?

CATHERINE RAMPELL: So this was among the ways that this version of the child tax credit differed from prior iterations of it, which, to be clear, had been around for many years, had been expanded under Democratic and Republican administrations alike.

But this was the first time that it became available to families with little or even no earnings.

So, let's say you're a kid and you're being cared for by an elderly grandparent who cannot work.

Your household got that funding too and was able to use it to pay for those necessities to be lifted out of poverty.

However, this aspect of the child tax credits design, the child allowances design has been controversial, right?

There have been fears that maybe giving money to households not conditional on work or any sort of earnings could discourage employment.

Based on the research to date, it does not look as if this expansion of the child tax credit had that effect.

There are certainly models out there that suggest that it could have some sort of depressing effect on labor supply, on employment.

Those are endlessly debated, those kinds of models.

But that's part of the reason why this version of the child tax credit has been controversial, why no Republicans support it.

However, there have been a number of Republicans who have gingerly put forward their own alternative versions of an expanded child tax credit, maybe with some kind of modest work requirements in there or a look-back, suggesting that the parents or guardians had prior years of earnings.

So it does seem like there might be room for compromise here potentially later this year, as lawmakers are hashing out some other negotiations over tax breaks and whether they should be extended, that there might be some room for a version that looks not quite like Biden's version, not quite like what Republicans are putting forth, but potentially somewhere in the middle.

STEPHANIE SY: Well, certainly, millions of American families watching to see if there's a revival of some sort of this COVID-era policy.

Catherine Rampell with The Washington Post, thanks so much.

CATHERINE RAMPELL: Thank you.

CDC director on updated COVID booster as infections rise

Video has Closed Captions

Clip: 9/12/2023 | 6m 28s | CDC director discusses updated COVID booster as infections rise from latest variant (6m 28s)

The challenges Ukraine's counteroffensive faces

Video has Closed Captions

Clip: 9/12/2023 | 5m 23s | The challenges Ukraine faces as counteroffensive slowly regains territory from Russians (5m 23s)

GOP Rep. McClain explains support for impeachment inquiry

Video has Closed Captions

Clip: 9/12/2023 | 6m 3s | GOP Congresswoman Lisa McClain explains why she supports impeachment inquiry of Biden (6m 3s)

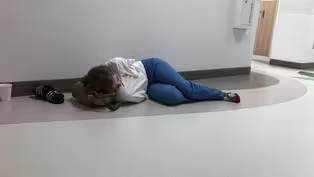

Mental health service shortage for teens creates challenges

Video has Closed Captions

Clip: 9/12/2023 | 10m 13s | Shortage of mental health services for teens forces parents to take desperate measures (10m 13s)

What McCarthy hopes to accomplish with impeachment inquiry

Video has Closed Captions

Clip: 9/12/2023 | 8m 10s | What McCarthy and House Republicans hope to accomplish with Biden impeachment inquiry (8m 10s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

- News and Public Affairs

Amanpour and Company features conversations with leaders and decision makers.

Support for PBS provided by:

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...