Safeguarding Our Seniors | Carolina Impact

Season 12 Episode 1207 | 27m 53sVideo has Closed Captions

Scam Awareness, Measures Before Passing, Senior Living Facilities, & Senior Self Defense.

Fighting back against senior scams & ID theft, by spotting ‘red flags’ of financial fraud, what measures should a person take before a loved one passes away? See what living options are available for NC seniors moving into the next phase of life, and find out how you can defend yourself in dangerous situations no matter your age.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Carolina Impact is a local public television program presented by PBS Charlotte

Safeguarding Our Seniors | Carolina Impact

Season 12 Episode 1207 | 27m 53sVideo has Closed Captions

Fighting back against senior scams & ID theft, by spotting ‘red flags’ of financial fraud, what measures should a person take before a loved one passes away? See what living options are available for NC seniors moving into the next phase of life, and find out how you can defend yourself in dangerous situations no matter your age.

Problems playing video? | Closed Captioning Feedback

How to Watch Carolina Impact

Carolina Impact is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Introducing PBS Charlotte Passport

Now you can stream more of your favorite PBS shows including Masterpiece, NOVA, Nature, Great British Baking Show and many more — online and in the PBS Video app.Providing Support for PBS.org

Learn Moreabout PBS online sponsorship(upbeat music) - [Narrator] This is a production of PBS Charlotte.

- This week on a special "Carolina Impact," "Safeguarding Our Seniors."

Showing you how to enjoy your golden years without the fears that come along with aging.

- Get on your phone, they screen shared on my phone.

It went to my account and started moving money in front of my eyes.

- [Amy] How to get better equipped so you're not ripped off by scams and hackers.

- [John] Being the target of a scam, and losing money, or losing sensitive information is not the victim's fault.

- [Amy] Better trained to defend and protect yourself from physical attackers.

- Before I started, I always thought that I would be one of those people who would just freeze in a situation like that.

But now at least I feel like I can fight back.

- [Amy] And better prepared to find the care you'll need when you're older in a place where you're not just another name in a folder.

- Care is very expensive, and so you have to plan for that as well.

- [Amy] If you're a senior or a caregiver, you don't have to face aging alone.

- Those families are in crisis, and they really don't have as many options as someone who has planned ahead.

- [Amy] Tonight, PBS answers your SOS for help on "Safeguarding Our Seniors."

Good evening.

Thanks so much for joining us for this special "Carolina Impact."

I'm Amy Burkett.

We start with a story that a lot of seniors don't wanna talk about, not even with their friends and family.

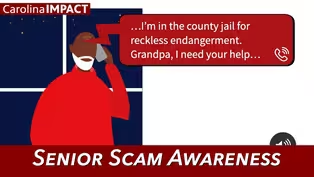

Financial fraud against seniors is a billion dollar black market business with 100,000 FBI complaints last year, all from victims over 60 years old.

But that doesn't count the scams against seniors that are never reported by victims who are embarrassed, or don't know they're being scammed.

"Carolina Impact's" Jeff Sonier, and Videographer, Max Arnold.

Take us inside the world of senior scams showing how seniors can fight back against fraud.

- Yeah, they say age is just a number, but when scammers and hackers here in Charlotte and elsewhere, get your other numbers, your social security number, your credit card number, even your phone number, well the older you are could mean the more vulnerable you are.

(upbeat music) - This was one of the scams that actually ran about four years ago.

Look at the differences.

You spot it?

- [Jeff] Scam Expert, John Tudor is teaching these AARP members what fraud looks like, what fraud sounds like.

- 'Cause we talk so many times a day, every day, I thought I knew 'em fairly well, which made me trust him.

- [Jeff] And how to recognize the red flags for themselves.

♪ Sending out an SOS ♪ So seniors know when to send out their own SOS.

- If it is unexpected communication.

- I get a lot of calls every day.

- If it has an emotional reaction, gets you worked up.

- Say, "I need your help."

- And if it demands an immediate action.

- It went to my account started moving money in front of my eyes.

♪ Sending out an SOS ♪ - [Jeff] Lynette Yankson tells other seniors in the group how she lost $500 in just a few minutes, on a call with a fake customer service line.

- So I'm talking to these people who I thought were customer service, they were not.

They were scammers.

- The goal is to get you to take action, jump in, and do something without stepping back and thinking, "Hmm, could this be a fraud?"

- [Jeff] Tudor adds that some of the scams are so common and so successful, that they even have names, like the so-called "Grandparents Scam."

- Someone poses as the victim's grandchild.

Okay?

And they're in trouble.

Alright, now check this out.

This is an action recording of a Grandfather Scam phone call.

- [Recording] "Hey Grandpa, how are you?

"I broke my nose.

"I was in a car accident.

"I'm in the county jail for reckless endangerment.

"Grandpa, I need your help, really.

"I love you.

I'm sorry."

(gentle piano music) - I mean, it's the same story.

- Yeah, it is.

Yeah.

Well, I've never heard about it before.

- [Jeff] Marvin Rouse says at least twice now, he's gotten similar calls here at his home home on his cell phone.

He called you Grandpa.

- Yeah, grandpa.

He said they was involved in a wreck.

And he said, "If I don't have money to post, "or pay a lawyer or something, "they're gonna lock me up."

- [Jeff] But what the scammers didn't know, is that Rouse doesn't have a grandson, only granddaughters.

He figures cash is what the scammers were calling for, but it's a story that he wasn't falling for.

- It was a good scam is the only way I can say it.

- [Jeff] Why'd they call you?

That's the question.

I guess I'm targeted for how old I am.

You know.

- I think about my grandmother.

And she used to guard that checkbook with her life.

Right?

- [Jeff] Mark Henry is founder and CEO of Alloy Wealth here in Charlotte, which manages the money of retirees, who risk losing their entire life savings to investment scammers, looking to cash in as seniors cash out of their pensions and 401 Ks, and social security benefits.

- They retired, had all these dreams, everything's great, and then someone calls with the right scam at the right time.

The internet, these scams are the new wild west.

- [Jeff] Henry says a lot of his clients complain about fake IRS calls threatening legal action, especially at tax time.

- [Recording] To get more information about this case file, please call immediately on our department number, 253-214-4667.

This call is officially a final notice from IRS, Internal Revenue Services.

- Understand what they're trying to do on the other line.

They're trying to get you to divulge information that allows them to get access to whatever it is they want, which is typically bank information, social security information, social security numbers.

They can apply for credit.

All the above.

- [Jeff] Henry adds that too many seniors are too trusting of someone on the phone who sounds official.

They're too willing to share the details that scammers are looking for.

And often, they're too embarrassed to tell even their closest family members that they've been fooled.

- Things to look for are unnecessary spending.

They're going, "Hey, what are you doing, Mom?"

"Oh, I'm going over to the bank."

"Well, you were just there a couple days ago."

"Yeah, yeah, I gotta go by.

"I gotta go by."

"What's going on?"

You have to look, because again, when they get in involved in the right scams, that's a train wreck.

(gentle piano music continues) - I was devastated.

Absolutely destroyed.

- [Jeff] Tudor ads that when audiences see the victims in his videos, they see themselves.

(gentle piano music continues) But it doesn't have to be that way.

- Better to put the responsibility on the ones who deserve it, the criminals.

Being the target of a scam, and losing money, or losing sensitive information is not the victim's fault.

Okay?

It's the fault of the criminal who perpetrated it.

(gentle piano music) - Yeah.

Tudor ads that a lot of seniors and their families just don't realize how many resources are really out there.

Not just scam workshops like the one we attended, but also online resources, all aimed at making sure that potential targets of scams don't also become victims of scams.

Amy.

- Thanks, Jeff.

To find out more about fighting fraud and reporting senior scams, check out our website, pbscharlotte.org.

You'll find links to senior scam hotlines and websites provided by AARP, the North Carolina Attorney General's Office, and the FBI.

All places where you can share information about scams.

Well, listen to this.

2024 will go down as a record breaking year for retirement, with an average of 11,000 Americans turning 65 each and every day.

Add it all up, and that's over 4 million Americans turning 65 this year alone.

It's expected to happen again in 2025, '26, and '27.

Dubbed as "the silver tsunami," It represents the largest surge of retirement age citizens in our nation's history.

But what types of things should these new retirees be thinking about in regard to finances and healthcare?

"Carolina Impact's" Jason Terzis joins us with more.

- The number 65.

It's a magical one of sorts.

The age when Americans become eligible for Medicare.

Although in North and South Carolina, the average retirement age is 63.

But for many, planning out their golden years can be a little intimidating with so many things to think about and ultimately plan out.

We reached out to the Charlotte Estate Planning Council asking the question, "What types of measures should people be taking?"

And that led us to three experts from three different fields.

- You know, one of the products that your financial advisor might talk to you about is a whole life policy with a long-term care rider.

- Oh.

- So it's sort of a hybrid, right?

And so- - Attorney, Nikki Applefield Engel meets with an associate to discuss life insurance.

- But if I cash it in, how much do I get back?

- So- - From all the money I put in it?

- A lot of times, nothing if you drop that policy.

(clients beats on the table) Yeah, that's the kicker.

- [Jason] Nicki is a certified elder law attorney with the Johnston Allison Hord Group in Charlotte.

- It's a wonderful area of law to be in.

And honestly, there are not enough us of us around.

- What's considered elder law runs the gamut as far as the various areas of law it deals with.

- Which can include, you know, healthcare planning, estate planning, asset protection, guardianship, probate, trust administration.

So you'd have to look at your policy, what are the benefits?

And also, you know, look at your income, look at the costs of care, the average increases.

- Nicki's job is to help clients navigate the legal system, putting them in position to seek out benefits, discussing options and advising clients on retirement planning.

- For older adults who are kind of facing the golden years, I think, you know, you have to, at the very least, have to have a foundational estate plan, which will include of course a will, financial power of attorney is very crucial.

Healthcare advanced directives, of course, are very important.

- [Jason] The biggest challenge facing retirees isn't necessarily having enough money for the retirement itself, but instead, for potential long-term care.

- That's really what we help to plan for is, is, you know, how do we protect assets so that if a long-term care event arises, you know, we are not having to deplete every last dime to pay for care, and we're able to leave a legacy for our family.

- Three (man grunts) Good job.

- [Nurse 2] Do one more for me.

- [Nurse 1] Get up.

Come on.

Tuck your bottom under.

There ya go.

(gentle piano music) - The average cost of assisted living is now $10,000 a month, with most people in care for an average of three to five years.

- Honestly, I never hear anyone say, "I wanna be in a nursing home."

Right?

Everybody says, "I wanna age at home, "and I wanna have care at home."

And of course that's a wonderful goal to have.

But, you know, understanding what that cost is, is very important too, because that could be even more than you know, facility care.

- [Jason] Another thing to consider and plan for if needed, are things like dementia and Alzheimer's.

- When we talk about estate planning, most people focus on, you know, death and planning for when you pass.

But just as important, or maybe even more so, is planning for incapacity.

And when we plan for incapacity, you know, we're thinking about, you know, powers of attorney, financial and healthcare.

- [Jason] And it's not just attorneys working in this space.

Jennifer Szakaly is a national certified care manager and master guardian.

She's the founder and CEO of Caregiving Corner.

- I started Caregiving Corner in 2005, and I started it really because I saw the need for additional advocates in the community to work with families, and help them understand the long-term care system, and help them really understand everything related to caregiving.

- [Jason] And that can mean everything from connecting people to healthcare services they need, setting up doctor's appointments, medication management, and communication with other family members.

- Our primary role is to be an advocate for the older adult, and help them live as independently as possible for as long as possible.

- [Jason] With more and more retirees not having children in the area, or having children at all, advocates like Caregiving Corner help fill in those gaps.

- So most of the time we are contacted by the adult children of the person who is aging.

Increasingly, we're seeing that those individuals do not live in the same city as their aging parents.

Increasingly, older adults are entering into aging, single, maybe never married, child free.

So they don't have the typical family structure that you had a generation ago.

- [Jason] And that's yet another reason why it's critically important to have plans in place, keep them updated, and make sure others know where to access them.

- Even something as simple as where the passwords are, or the combination to a safety deposit box.

So any number of different things that could cause a hiccup down the road after that person is gone, or after they're no longer able to give you that information.

Any of those kinds of things that you can get out of the way ahead of time is really, really critical.

The people that wait, and kind of bury their head in the sand, and they assume that they're never gonna need care, they're never gonna have to move out of their house, those are the people unfortunately, that leave families really wondering whether or not they're doing the right thing, whether or not they're doing what their parents would've wanted them to do.

And those families are in crisis, and they really don't have as many options as someone who has planned ahead.

- [Jason] In addition to legal documents like wills, trusts, and powers of attorney, is documentation of personal assets.

- The old adage, "One man's trash is another man's treasure," really rings true in this industry.

- [Jason] Kait Marley is an accredited member of the International Society of Appraisers, and the managing director with Arcadia Art Consultants.

She works with wealth managers, estate planning attorneys and families, in assessing personal property and collections.

- One of the things that we offer to clients, and we really recommend for clients, whether they're working with us or with someone else, is to make sure that they are seeking unbiased support.

So making sure that the person who's giving the opinion, isn't someone who's going to be directly benefiting from the opinion that they're providing.

- Okay, Jason, so I noticed a theme in your story about important documentation.

How important is that?

- Yeah, that's the one thing that all three of our experts said.

They all said the same thing in that regard.

First, decide what you want in terms of finances, healthcare, and personal property.

Second, have all the necessary paperwork completed and filed away.

Save the physical copies as well as the online versions.

Third, make sure your loved ones know what your wishes are, where to find all that documentation, and when it comes to things like wills, powers of attorney and trusts, update them periodically.

In many instances, those documents are years, or even decades old, and things of value can change over time, as well as people's wishes and desires.

Those tend to change.

So get the documentation, keep it updated, let people know.

Especially things like those passwords and others that we talked about in the story.

Just gotta know where the information is.

- You and I both have parents in their nineties, so this is something very close to our hearts as well.

Thanks for all the great information.

- Absolutely.

- Well, now you know how to protect your money and your assets, so let's talk about where you'll live.

Moving into the next phase of life can be daunting, but exploring retirement options, you know how stressful they can be too, especially when it comes to housing.

Here in the Tar Hill state, research shows we rank ninth nationally in population of folks 65 and older.

"Carolina Impact's" Dara Khaalid, and Videographer, John Branscum break down some of your living options.

- [Dara] Every week you'll find her in the same place.

- Three crack.

- [Dara] Surrounded by friends at The Barclay at SouthPark playing Mahjong in the game room.

- Oh, I'll call that.

- For Marilyn Prensky, this is the life, (Marilyn laughs) laughing and enjoying her golden years at this continuing care retirement community.

- I don't have to get in my car, and drive anywhere to get to a game, or to do anything.

All I have to do is walk, come in the elevator.

- The elevator.

- And we're there.

(gentle piano music) - [Dara] Same for her friend and fellow resident, Bev Nordmann.

- We were looking for a place where we could retire completely.

We are all in an age category.

And this was the most accessible.

- [Dara] While everything looks great now for the ladies, Marilyn's transition wasn't easy.

- We're in Tucson for 24 years.

We had wonderful friends.

And to leave that to an unknown, knowing no one except for our children, that was very scary.

- [Dara] She and her husband Ira, made the decision to leave Arizona over a year ago to be closer to their daughter.

- The hardest thing was knowing where all our stuff was going to go.

We had a lot of things, stuff, that I really felt I couldn't do without.

- [Dara] Tough choices like this are only a portion of what many have to consider when they're transitioning to a new home to fit their needs.

- They feel that they're giving up their independence, and they feel that they're giving those choices.

- [Dara] Hillary Kaylor, a regional ombudsman with the Centralina Area Agency on Aging, says there's also the reality of where they're going to live, and how they're going to pay for it.

- Care is very expensive, and so you have to plan for that as well, see what else you have if you have long-term care insurance that may cover it, if it's your private pay funds, what your social security may contribute to that, your pensions.

- [Dara] Here are a few options.

An assisted living facility for people who need daily care, like getting dressed and preparing meals.

The average monthly cost in Charlotte is around $4,200.

Or a nursing home, for those who need more medical care, and help with activities like occupational therapy.

The average monthly cost starts around $9,000 compared to memory care facilities priced around $7,000.

Back at The Barclay at SouthPark, you'll also find continuing care.

- What that basically means is that we have all levels of care under one roof.

So we do offer independent living, assisted living, memory support, as well as a skilled nursing rehab.

- [Dara] Its average monthly cost starts around $6,700, and can go over $10,000.

Aldersgate is another continuing care retirement community in Charlotte, with an average monthly cost between $5,500 and $12,000 for members living in the healthcare spaces.

Here, you'll find 97-year-old Lucile Cole getting daily help from one of her caregivers.

- We are friends, and each feels free to let each other know what's bothering them or pleasing them.

- [Dara] After a fall in 2023 that left her with a broken shoulder and cracked pelvis, her daughter tells us this home care service has been a major part of her recovery.

- I love you so much.

- It's hard to watch your parent age.

It's hard to watch 'em come to the point of death three or four times in a two year period, and still have 'em on the other end.

And I credit the care, the caregiving.

- [Dara] Regardless of where you live, experts say it's important to fully understand what you're getting into.

- Laney, I'm gonna take you into our model, two bedroom/two bath.

The first step is go out and visit.

Understand different financial models.

They're not all the same.

Senior living communities have non-entrance fee rental models like what we are, - [Dara] Which means they don't collect your nest egg.

Instead, you sign a 13 month lease, and there's a monthly service fee.

- There are entrance fee models, there are equity models.

Each one has its kind of own financial arrangement.

- [Dara] The entrance model fee requires you to pay an upfront fee once, and according to AARP, the average price is around $402,000.

The equity model means you own your place, and are able to resell it.

- It's not a matter of you know what's good, bad, right or wrong, they're all just so different.

So you really have to go out and educate yourself to understand what the benefits are to to each type, and see what the best fit is for you.

- [Dara] It's also important to tell your family, sooner rather than later, what your desired living plans are for the future, so that when it's your time to transition like Marilyn, There's less confusion and you have more control.

For "Carolina Impact," I'm Dara Khaalid.

- Thank you, Dara.

Most assisted living communities require people to be at least 55 years old to move in.

However, experts tell us there's no exact age to begin the process.

They recommend starting before an emergency happens, because we all know we make our best decisions when we're not stressed.

Wrapping up tonight's special, according to the Centers for Disease Control, as the number of Americans, 60 and older rises, the rate of violence against them is rising even faster.

It estimates that the rate of non-deadly assaults against men 60 and older may have increased by as much as 75% from 2002 to 2022.

The rate of assaults for women of that age rose by more than 35%.

This means for many Americans, the golden years aren't so golden when you have to defend yourself.

It's also led to an uptick in the number of seniors wanting to learn how to protect themselves.

"Carolina Impact's" Beatrice Thompson and Videographer Russ Hunsinger.

Take a closer look.

(melancholy piano music) - [Bea] At first glance, you might think it's just another group of so-called gym rats working on their muscles, doing reps. - On three.

(claps hands) Whew!

- But look closely.

Many are in their older years.

What the world term "seniors."

- Let's go!

Let's go!

- [Bea] But they are not here just to pump iron.

They're here to make sure their bodies are prepared if they're ever victims of an attacker.

- I've been a victim of gun violence.

And so knowing immediately, "Oh God, this is real."

Like this is the real deal.

- [Bea] The 50 something trainee says that moment made her aware that she had to do something to protect herself, and so began taking the classes with a friend at Fit to Fight, here in Charlotte.

- You can continue to be a victim and live in that victimhood, or you can learn skill sets to get out of that.

- Be aware of who's around you!

Switch!

I wanted something that was a little more geared towards what I would say is realistic self-defense, and things for people of all ages.

Hip and shoulder go first.

- [Bea] Ryan Hoover has worked with his clients for more than a decade.

As a trainer, he knows senior participants have their own set of concerns, including staying healthy enough to defend themselves.

He says that involves more than the physical side of self-defense.

- The name, Fit to Fight is obviously intentional, the fitness component, but that's not just physically fit, but mentally and emotionally fit to be able to deal with whatever kind of life throws at us.

And then the fight side, being able to physically defend ourselves if we have to.

- [Bea] And the statistics bear out the need to protect themselves.

According to the National Council on Aging, one in 10 Americans age 60 or more have experienced some form of elder abuse.

The National Center for Victims of Crime says in 2015, seven of every 1000 victims was a woman 65 or older.

Three of every 1000 victims were men, and only 45% of violent acts against people over 65 were ever reported to police.

- They were easy to be victimized through various scams and other things, and even physically taken advantage of older citizens.

Yes, this is something that's unfortunately common.

- [Bea] Rodney Collins recently retired as a police officer, and says their concerns, and those statistics are all true.

- Older.

There's less physical attributes that an older person would have versus a younger.

So to the criminal mind, that that's an easy target.

- [Bea] Bruce Gordon came to Charlotte from New York 20 years ago, and has taken more on arts since he was a child.

But says this training fits his current lifestyle and needs.

- This school is more realistic for self defense in the world the way it is today.

It's not just about the blocks, and kicks and punches.

It's the mindset and everything else.

So, this place is like medicine to me.

- It was a good way to get exercise, and you're learning how to do something.

So that's just, that's what I was in for.

- [Bea] The 76-year-old Gastonian has been doing this for more than a decade, not only increasing his mobility, but learning how to defend himself and his wife.

And as for his friends around him doing this.

- All my friends are about my age, or a few years younger, and they're all, all they talk about is insurance, and health, and how many doctor's appointments they got and how many pills they take.

- I've always wanted to learn self-defense, being a woman, being of small stature, just a little bit of insurance, and I guess a little bit of confidence.

- Cindy Schaefer moved to Charlotte from Pennsylvania three years ago.

With age 60 coming up, she made her decision to increase her self-defense skills.

- Before I started, I always thought that I would be one of those people who would just freeze in a situation like that.

But now at least I, I feel like I can fight back.

- [Bea] Hoover sees the growth in his students, and says each one moves at their own levels.

He also sees when they make a personal breakthrough.

- They had things in their lives that happened to them, and they're gonna show up here, and they're gonna leave here feeling better about themselves, and they're gonna feel stronger and more healthy.

- [Bea] And while the seniors are doing it for themselves, they're also serving as inspiration for that younger, 50 something crowd.

- The biggest thing I've gotten from training with people who are older than me, even if it's three to 10 years older, 20 years older, is it gives me a goal to shoot for.

When I'm 70, in my seventies, I wanna still be able to do this.

- [Bea] And what does it mean for all of us?

That life does not end when you become a senior.

It turns into the life that you want to lead.

- Thanks, everybody.

Appreciate you.

(participants applaud) - [Bea] For "Carolina Impact," I'm Bea Thompson.

- Great information.

Thanks, Bea.

The instructors point out, each person moves at their own pace.

They say it's about more than punches and kicks, it includes teaching people to be aware of their surroundings, to be mentally and physically prepared for any type of confrontation, including when to leave a situation.

As we wrap up this special "Carolina Impact," we hope you've gained valuable insights, as we've answered your SOS for help on safeguarding our seniors.

The key is being proactive.

Thank you so much for joining us.

As we've tackled these critical issues, together, we can create a supportive community where everyone feels safe and valued.

Goodnight, my friends.

(rousing upbeat music) - [Announcer] This is a production of PBS Charlotte.

Measures To Take Before Passing

Video has Closed Captions

Clip: S12 Ep1207 | 5m 29s | What measures should a person take before a loved one passes away? (5m 29s)

Safeguarding Our Seniors Preview | Carolina Impact

Preview: S12 Ep1207 | 30s | Scam Awareness, Measures Before Passing, Senior Living Facilities, & Senior Self Defense. (30s)

Video has Closed Captions

Clip: S12 Ep1207 | 5m | See what living options are available for NC seniors moving into the next phase of life. (5m)

Video has Closed Captions

Clip: S12 Ep1207 | 5m 37s | Fighting back against senior scams & ID theft, by spotting ‘red flags’ of financial fraud. (5m 37s)

Video has Closed Captions

Clip: S12 Ep1207 | 5m | Find out how you can defend yourself in dangerous situations no matter your age. (5m)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

Carolina Impact is a local public television program presented by PBS Charlotte