Borrowers face upcoming resumption of student loan payments

Clip: 6/14/2023 | 10m 11sVideo has Closed Captions

Borrowers face tough decisions as resumption of student loan payments approaches

In just a matter of days, the Supreme Court is expected to rule on whether President Biden’s student debt forgiveness can go forward. It comes as the resumption of student loan payments approaches. Ahead of the decision, we hear from borrowers concerned about what’s ahead and William Brangham discusses student debt with Julia Carpenter of the Wall Street Journal.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...

Borrowers face upcoming resumption of student loan payments

Clip: 6/14/2023 | 10m 11sVideo has Closed Captions

In just a matter of days, the Supreme Court is expected to rule on whether President Biden’s student debt forgiveness can go forward. It comes as the resumption of student loan payments approaches. Ahead of the decision, we hear from borrowers concerned about what’s ahead and William Brangham discusses student debt with Julia Carpenter of the Wall Street Journal.

Problems playing video? | Closed Captioning Feedback

How to Watch PBS News Hour

PBS News Hour is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipGEOFF BENNETT: In just a matter of days, the U.S. Supreme Court is expected to rule on whether President Biden's plan for student debt forgiveness can go forward.

It comes at a major moment for borrowers, who may have to restart those loan payments this fall.

William Brangham gets some perspective about those concerns and what borrowers may need to think about.

WILLIAM BRANGHAM: The president's plan would forgive as much as $20,000 of student loan debt for many borrowers.

Before that plan was put on hold, over 16 million people were approved for that forgiveness.

And, if enacted, that could cost the government as much as $400 billion.

While that's been playing out, for three years since the start of the pandemic, interest and principal payments on federal student loans have been paused, but they're set to resume in just a few months.

All this has left a lot borrowers worrying about what's ahead.

Here's what a few of them told us.

And none of these people are just out of school.

They work in education and for local government agencies.

DANIEL CASSELY, Massachusetts: My name is Daniel Cassely, and I'm located in South Weymouth, Massachusetts.

CAROLANNE FRY, Oregon: My name is Carolanne Fry.

And I'm a fourth-generation Oregonian living in Portland Oregon.

CHRISTOPHER WATERS, Delaware: My name is Christopher Waters.

I am located in Wilmington, Delaware.

DANIEL CASSELY: If the Supreme Court does wind up striking down the Biden forgiveness program, it's just going to prolong the things that I'm looking forward to really in life, being able to retire maybe sooner, helping my son, who is 11, to be able to go to college.

CAROLANNE FRY: Yes, it's going to be a lot of recalculating, definitely tightening.

Won't be able to put money into savings, which is very scary for me as, like, a single person living more paycheck to paycheck.

CHRISTOPHER WATERS: I think having that burden come back, and not having any type of relief, would be almost catastrophic, as costs have gone up, as prices have gone up, as the cost of education has even gone up over the years.

DANIEL CASSELY: Paying almost $400 a month for the next 12, 13 years is a lot of money.

CAROLANNE FRY: I think that my payments will probably be about $400 hours a month, which is quite a significant amount of money for me.

I live alone.

CHRISTOPHER WATERS: For me, finance will most definitely tighten up.

There would be almost an instant -- a bill due instantly, and a lot of money that, for me personally is -- for me personally is a lot of money.

DANIEL CASSELY: I do see the benefits of going to college.

However, it needs to be a very financially stable way to do things.

CAROLANNE FRY: Getting that college education was so key to me having some stability in my life.

And I feel like I had to take out that debt.

CHRISTOPHER WATERS: When I -- I think of myself, when I went to undergrad, my undergrad total cost me, at most, $25,000.

If my -- if my children decide to go to the same university, it would cost them about $125,000 for the same -- for the same university.

CAROLANNE FRY: Even with the $20,000 that is in front of the Supreme Court right now, debt forgiveness, I would still have about $30,000 in debt left over.

CHRISTOPHER WATERS: I haven't been on an income payment plan since almost like March 2020.

And that pause has allowed me to put money in other places, the rising cost of rent, rising cost of food, rising costs of just everything.

And incorporate -- incorporate a payment of $300 back into my budget every month would be would be -- would be -- it'd be almost the same as almost if I bought another car.

CAROLANNE FRY: We elected President Biden with this promise of the student loan forgiveness.

And I don't know when he promised that if he fully knew it could go through.

Like, we were all just hoping.

But it's really looking bleak.

And there are a lot of people who are significantly depending on that forgiveness.

And to have that kind of rug pulled out from underneath them is not going to be a good look.

WILLIAM BRANGHAM: So, given these potentially significant changes, we wanted to get some perspective on how borrowers ought to be planning.

Julia Carpenter focuses on that for The Wall Street Journal, and she joins us now.

Julia, thank you so much for being here.

As we were hearing, these federal student loan payments were suspended at the start of the pandemic, and then they kept getting renewed and renewed and renewed and renewed.

Is there any chance that they could get renewed again?

JULIA CARPENTER, The Wall Street Journal: President Biden said earlier this year that payments will resume in the summer.

And now that we know there is a Supreme Court decision looming on forgiveness, that is almost impossible that we would see another delay.

We know now August 30 is when payments are set to resume, and people will have until October to make payments.

WILLIAM BRANGHAM: So, how many people are we talking about that are going to suddenly see, as we were just hearing from those three, they're going to suddenly start to see these payments come due?

JULIA CARPENTER: Millions.

Millions.

I mean, fewer than 2 percent of borrowers continued making payments on their student loans during the payment pause on interest accrual.

And everyone else took the pause as an opportunity to either get their financial lives in order during the pandemic or a break in interest, which had been ballooning their balances.

So, some 30 million people are going to see their accounts resume as of August.

WILLIAM BRANGHAM: And so, as you're saying, broadly speaking, what did people do with those savings?

Did people bank any of that?

Did most people just start to spend more?

Did -- I mean, inflation, obviously chewed into some of that as well.

JULIA CARPENTER: I talked to a lot of borrowers who saved it.

I talked to a lot of borrowers who said, finally, this is my chance to put this money away, save for a rainy day, stock up that emergency fund I have always been told that I should have.

But I talked to a ton of borrowers who said it just disappeared.

They saw their grocery bills higher.

They saw their car payment higher.

They started going back to the office, and they were paying more on gas than they had been in months previous.

And the money that they had intentionally earmarked for student loans was sort of sucked up into the day-to-day expenses.

WILLIAM BRANGHAM: So, separately, we are -- as you were mentioning, this Supreme Court ruling is coming any day now.

Can you just remind us what President Biden wanted to do and then what the court might do?

JULIA CARPENTER: The original plan promised $10,000 to borrowers with federal student loans with income under $125,000.

And for couples, that's slightly different.

If you were a Pell Grant recipient, you are eligible for up to $20,000 in forgiveness, again, same income restrictions.

So qualified borrowers would see their balances lowered as a result of this plan, which, of course, now is being debated.

WILLIAM BRANGHAM: So, I know you're not a financial adviser and don't even play one on TV.

But I know you have talk to a lot of them for your job.

What should people be doing who might have these sudden payments reappearing on their -- on their balance sheets?

What should they be doing in advance of this?

JULIA CARPENTER: Every financial adviser I spoke to about this had the same advice, which was, hope for the best, plan for the worst.

So, if you're a qualified borrower, if you would be eligible for up to $20,000 in forgiveness, these financial advisers are saying to plan as though you won't be getting forgiveness.

That way, should forgiveness be ruled unconstitutional by the Supreme Court, you won't be taken by surprise.

You will have planned in advance.

Looking at your cash flow, looking at your existing financial plan, and seeing where you could cut or where you could move money or where you could reallocate in order to free up room for that payment to be reabsorbed is the best-case scenario.

And then, if the plan is ruled constitutional, and you receive forgiveness, then you still plan for the worst and you won't be taking those risks.

WILLIAM BRANGHAM: Do you think -- this touches back on this larger financial literacy issue.

Do you think borrowers get enough advice and education to understand how interest payments work and how -- what they're really signing up for when they sign up?

JULIA CARPENTER: I always ask that question when I interview borrowers.

I always ask them to go back to when they were 18, when they were deciding where to go to college and how much they would be paying for college.

And, without exception, every single person says they wish they had had greater education as to that question.

WILLIAM BRANGHAM: The point of going into debt, obviously, is to go to college, and then you get a better job, theoretically, and better income, and you can pay that debt off.

Do we generally know, as a society, how that has panned out for people?

I mean, has it been a wise investment for most people?

JULIA CARPENTER: We know that people with college degrees attain higher incomes.

That's clear.

But what we don't know is how student loan balances affect that earning power over time.

I was just interviewing someone earlier today who attended one year of college and is still carrying a student loan balance as a result.

So, if you have accrued debt as a result of attending some college, those are the people who are often hurting the most.

WILLIAM BRANGHAM: Right.

The critics of student loan forgiveness argue, you knew what you were signing up for, to some extent.

It is not the government's job to bail you out if you got over your skis with these kinds of payments.

What do advocates of forgiveness say in response to that?

JULIA CARPENTER: I speak with a lot of borrowers who say that interest is the enemy here, that they have watched their student loan balances grow, that their incomes have not been able to keep up with payments, that their earning power has stagnated, and they would love nothing more than to be able to eliminate this debt and pay down their loans.

But, as a result of the interest, they're unable to.

WILLIAM BRANGHAM: All right, Julia Carpenter of The Wall Street Journal, thank you so much for helping us wade through this.

JULIA CARPENTER: Thank you for having me.

Battle for power in Sudan reignites conflict in Darfur

Video has Closed Captions

Clip: 6/14/2023 | 7m 45s | Battle for power in Sudan reignites conflict in Darfur (7m 45s)

A Brief But Spectacular take on textile waste

Video has Closed Captions

Clip: 6/14/2023 | 3m 21s | A Brief But Spectacular take on textile waste and fashion sustainability (3m 21s)

Group of orcas attack and sink vessels off Iberian Peninsula

Video has Closed Captions

Clip: 6/14/2023 | 4m 25s | Group of orcas attack and sink vessels off Iberian Peninsula (4m 25s)

Iowa Republicans discuss Trump's federal indictment

Video has Closed Captions

Clip: 6/14/2023 | 11m 3s | What Iowa Republicans are thinking after Trump's federal indictment (11m 3s)

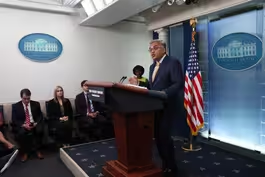

White House COVID coordinator on preparing for next pandemic

Video has Closed Captions

Clip: 6/14/2023 | 8m 9s | Outgoing White House COVID response coordinator on being prepared for another pandemic (8m 9s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

- News and Public Affairs

Amanpour and Company features conversations with leaders and decision makers.

Support for PBS provided by:

Major corporate funding for the PBS News Hour is provided by BDO, BNSF, Consumer Cellular, American Cruise Lines, and Raymond James. Funding for the PBS NewsHour Weekend is provided by...