The Fed Kicks Off Meetings on Whether to Cut Interest Rate

Clip: 9/16/2025 | 8m 53sVideo has Closed Captions

The decision could have major ripple effects on the economy.

The meeting comes against a backdrop of increased pressure from President Donald Trump as he tries to gain more control over the Fed — calling on it to set lower interest rates and suggesting he could fire Fed chair Jerome Powell.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Chicago Tonight is a local public television program presented by WTTW

WTTW video streaming support provided by members and sponsors.

The Fed Kicks Off Meetings on Whether to Cut Interest Rate

Clip: 9/16/2025 | 8m 53sVideo has Closed Captions

The meeting comes against a backdrop of increased pressure from President Donald Trump as he tries to gain more control over the Fed — calling on it to set lower interest rates and suggesting he could fire Fed chair Jerome Powell.

Problems playing video? | Closed Captioning Feedback

How to Watch Chicago Tonight

Chicago Tonight is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

WTTW News Explains

In this Emmy Award-winning series, WTTW News tackles your questions — big and small — about life in the Chicago area. Our video animations guide you through local government, city history, public utilities and everything in between.Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipclosely as the Federal Reserve kicks off a two-day meeting on whether to lower interest rates.

The decision could have major ripple effect on the economy and it comes against a backdrop of increased pressure from President Trump as he tries to gain more control over the Fed, calling on it to set lower interest rates and suggesting he could fire Fed Chair Jerome Powell just last night, an appeals court ruled Federal Reserve Governor Lisa Cook can remain on the board as Trump race to unseat her before the start of today's meeting.

Joining us with more are Martin.

I can bomb professor of economics at the Weinberg College of Arts and Sciences at Northwestern University.

And LeBron clinical professor of finance at the Kellogg School of Management at Northwestern Gentlemen, thank you both for joining Martin, I'd like to start with you.

What do you expect to come out of this week's Fed meeting?

Judging by the markets?

>> And various other sources, I think it's reasonable to anticipate decline in the interest There's some question about how much I would guess, but don't know they would move gradually.

So maybe 25 basis points for now and perhaps signaling further changes.

>> And why might the Fed shoes to lower interest rates now?

Well, it is a great question.

I think understand the background.

The Fed has a dual mandate.

>> Essentially of keeping employment going and keeping inflation down.

And they're constantly balancing that mix.

So they're a little bit of a bind.

But it is true that the economy seems to be showing some signs of slowing.

The Labor Day.

That was not particularly strong and revisions were negative.

So and just anecdotally, things seem to be slowing down.

Why had tough Coleman?

Well, if you lower rates, you probably will boost.

Growth in the economy, at least temporarily.

But that will put further pressure is on prices.

The downside of all of this is that the Fed is still below its target level of inflation, which is about 2%.

And we're roughly a 2.8% in.

So they're this terrible position having to choose which of their goals they can get priority too.

>> Yeah, a little bit at loggerheads Philip.

Ron, do you think this is the right time to to lower rates?

>> rather see the fact stay steady and what you're doing right now another month or 2 or inflation data this eye, whether inflation is is going dramatically up or it can be managed.

So.

I as Martin said, quarter point, we've got in the in the Fed funds rate not going that big of a fact.

So it's certainly a new of the meeting.

But no matter what the Federal Reserve does, whatever choice they make is not going to be is.

Both point keeping.

It very tight.

Moving along, have problems.

>> And how has the Federal Reserve approach setting interest rates in recent months saying, you know, we heard a bit about sort of the the different priorities they have to juggle.

>> profoundly inflation fighter and you and those that are their main goal time being now they're going to have to put both inflation fighter as well as a slowing economy fighter and their college.

Same time.

>> Martin, I can you know, there's been a lot of uncertainty with President Trump's put it on again off again tariff policies.

Now that things have more or less settled, what kind of effects are we starting to see?

>> I think you're starting to see the effects of tariffs and various prices.

It took a while for people to work down their inventories.

But you're now seeing those price pressures for many of the viewers.

If they bought a cup of coffee recently that notice the price of coffee is going crazy.

That's not unrelated to the tariffs that we Brazil and the fact that 50% of the coffee beans that we use come from Brazil.

So that's starting to see through any broader, a broader context.

More General Leslie seems to me is an uncertainty is a bad thing.

So if I'm businessman, person should say and I'm deciding whether to invest more or less uncertainty is going to be may be much more cautious.

And so I think this stock go.

Politics policy.

This way of proceeding really hurt investment.

And we're also seeing that in the data think that's a significant contributor to the softening in the decline on the real saying the economy.

>> Yeah.

Even for folks who might not have ahead for economics, coffee prices hurt an easy way into the question.

To LeBron.

You know, the Bureau of Labor Statistics found that the job market is is much weaker than initially thought.

With about 900 fewer jobs added in 2024.

2025 than previously reported.

What do you think is driving that?

>> I think you know, a slow downward.

We're seeing good start just this year or anything.

It's been a slow process that's going on for a while.

that's what they reflect.

They don't reflect.

military flack to bias or anything like that.

They simply reflect with the way the world actually look.

>> You know, Martin, I can we know President Trump wants more control over the Fed, attempting to fire a member of its board of governors.

And he's been putting pressure on the Fed to lower interest rates.

What's your reaction to that kind of interference?

>> I think it's very dangerous.

So let me say defense should be held accountable for its policies and it the chairman testifies before Congress and all the governors are up for reappointment a amount of time.

>> I think history is pretty unkind to attempts to interfere on tree with the independence of monetary policy.

And I think just wanted to add a point of view.

Politicians often have a relatively short horizons.

They're worried about the next election office.

And so they're always tended to lower interest rates to boost the economy to achieve that objective.

History has taught us that when they do that, the result often a lot of inflationary pressures.

So, you know, Richard Nixon was famous for doing that with the then chairman north Birds in the tapes are not pleasant to listen to, especially if you don't like that didn't turn out well, that didn't turn out well, but it's not just the United States.

think this is a worldwide phenomenon that way the politicians get their hands on monetary policy.

They inevitably have a bias to the expansionary.

To the point where it often causes inflation.

Philip, Ron, same question to you.

What do you make of this pressure from the executive branch?

>> I think it's very unfortunate.

I mean, current knows about monetary policy that does about here.

>> Well, you know, we if it is in very recent past in there and he in Turkey inflation above 50% Argentina.

One point almost 300%.

>> And this is caused politicians.

Were down?

They're spending ability and pretty money through this and where rather than managing the Money Spice Channel.

2 news.

So it'll be a disaster.

from his control.

The Fed in addition to interest rate rep Toledo.

>> We've got about a 20 seconds left.

But, you know, Martin, I can What's your overall outlook on what people should expect from the economy over the course of the year?

>> Well, I think like many people in particular, people in the private sector, there is a lot of uncertainty above the look forward.

And if you look at indices of uncertainty there record levels, the various economists put together levels of indices.

That said, I do think we're slowing down and I don't think inflation is coming down as quickly as the Fed would like it to.

And so if you ask me, what do I think inflation is going to be over the next year?

Probably about what it is now, which is 2.8% And that is above the Fed's stated target of 2%.

And it hurt a lot of people.

>> All right.

Well, there's much more we could cover here.

But unfortunately, that's all the time that we have for this

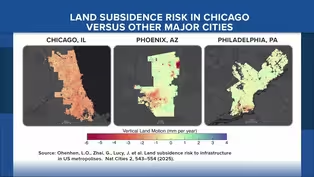

Chicago is Sinking. Here's What Researchers Have to Say

Video has Closed Captions

Clip: 9/16/2025 | 5m 56s | What was once thought to be a mainly coastal phenomenon is now showing up in most major cities. (5m 56s)

Trump Again Vows to Send National Guard to Chicago; Pritzker Fires Back

Video has Closed Captions

Clip: 9/16/2025 | 3m 33s | Gov. JB Pritzker said he thinks Trump is “losing it” after another threat of a military deployment. (3m 33s)

WTTW News Explains: Why is Chicago Sinking?

Video has Closed Captions

Clip: 9/16/2025 | 2m 40s | While it may be happening slowly, the consequences could be huge. WTTW News explains. (2m 40s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

Chicago Tonight is a local public television program presented by WTTW

WTTW video streaming support provided by members and sponsors.