RMPBS Original Documentaries

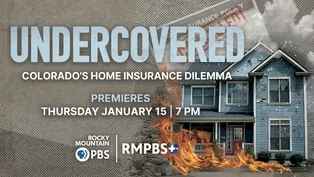

Undercovered: Colorado's Home Insurance Dilemma

1/8/2026 | 26m 40sVideo has Closed Captions

The state’s looming home insurance crisis puts pressure on homeowners.

Homeowners in Colorado face difficult decisions when it comes to insuring their home. With increasing fires and more intensive hail, we look into the looming crisis - and what the state government is doing to address it.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

RMPBS Original Documentaries is a local public television program presented by RMPBS

RMPBS Original Documentaries

Undercovered: Colorado's Home Insurance Dilemma

1/8/2026 | 26m 40sVideo has Closed Captions

Homeowners in Colorado face difficult decisions when it comes to insuring their home. With increasing fires and more intensive hail, we look into the looming crisis - and what the state government is doing to address it.

Problems playing video? | Closed Captioning Feedback

How to Watch RMPBS Original Documentaries

RMPBS Original Documentaries is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorshipIN THIS NEIGHBORHOOD, ALL 171 HOUSES GOT DESTROYED.

TO GET THE HOUSE BACK, IT WAS HALF A MILLION MORE THAN WHAT INSURANCE PAID.

- IT DESTABILIZED US QUITE A BIT.

I DON'T THINK WE'RE BACK.

IT WILL TAKE US A WHILE TO BE BACK.

- WE DID HAVE ONE COMPANY DROP US.

ALMOST EVERY CONVERSATION THAT WE HAVE WITH PEOPLE UP HERE, INSURANCE COMES UP.

- WE ARE IN THE MOST CHALLENGING PROPERTY INSURANCE MARKET THAT WE'VE SEEN IN A GENERATION.

WE'RE IN THIS COLLISION COURSE OF HARD MARKET CONDITIONS COLLIDING WITH RECORD BREAKING CATASTROPHES.

- HOW MUCH OF YOUR WORK HAS BEEN DEALING WITH THE AFTERMATH OF SEVERE WEATHER?

- IT HAS PROBABLY BEEN ABOUT 80% IN THE LAST 5-6 YEARS.

THERE'S BEEN A LOT OF DAMAGE DONE BY MOTHER NATURE.

- WHEN WE TALK ABOUT THE COST OF HOUSING, WE HAVE TO TALK ABOUT INSURANCE AS PART OF THAT.

THAT IS ABSOLUTELY BECOMING A SIGNIFICANT PART OF SOMEBODY'S MONTHLY COST TO OWN A HOME.

ACROSS COLORADO, HOMEOWNERS ARE FACING DIFFICULT DECISIONS WHEN IT COMES TO HOME INSURANCE.

PRICES ARE STEEP AND AVAILABILITY IS LIMITED OR IN SOME CASES NOT AVAILABLE AT ALL.

- LET'S SEE SOME OF THE DAMAGE YOUR HOUSE SUSTAINED IN THE STORM.

- SURE, YEAH, COME OVER HERE.

I'M BENTE BIRKLAND, A PUBLIC AFFAIRS REPORTER FOR COLORADO PUBLIC RADIO.

I TEAMED UP WITH ROCKY MOUNTAIN PBS TO UNDERSTAND WHAT EXACTLY COLORADO'S HOMEOWNERS ARE EXPERIENCING.

- THE FIRE, WE HAVE NO IDEA FROM THIS CAMERA, BUT IT WENT ALL AROUND ALL SIDES OF THE HOUSE.

- AND HOW PREPARED THE STATE IS FOR A FUTURE OF GREATER AND GREATER WEATHER DISASTERS.

(MUSIC PLAYING) - IN 2008, MANU SOBTI AND HIS WIFE AMITA MOVED TO A SUBDIVISION IN SUPERIOR IN BOULDER COUNTY.

- THEY ENJOYED THE NEIGHBORHOOD FOR MORE THAN A DECADE.

BUT IN 2021, THEY BECAME VICTIMS OF THE MOST COSTLY AND DESTRUCTIVE FIRE IN STATE HISTORY, THE MARSHALL FIRE.

THE MARSHALL FIRE BEGAN THE MORNING OF DECEMBER 30TH, 2021, IN AN AREA OF GRASSES IN BOULDER COUNTY.

- GO EAST, YEAH, TOWARDS DENVER.

- OKAY.

- GO TOWARDS DENVER.

EVACUATE, NOW.

- THE FIRE, SPURRED BY FIERCE WINDS, LASTED DAYS AND DESTROYED MORE THAN 1,000 HOMES.

- THAT SCENE BEHIND YOU IS JUST FRIGHTENING.

- REMARKABLY, IT WAS A MOSTLY SUBURBAN FIRE IN THE MIDDLE OF WINTER.

MANU AND HIS FAMILY WEREN'T THERE WHEN IT HAPPENED.

THEY WERE ON A FAMILY VACATION IN MEXICO OVER THEIR KIDS' WINTER BREAK.

- IT WAS REALLY LIKE A SHOCK.

LIKE YOU WOULDN'T EXPECT JUST NEIGHBORS TO BE CALLING YOU AND SAYING THAT YOUR HOUSE JUST BURNED DOWN.

MANU'S NEIGHBORHOOD WAS ONE OF THE MOST IMPACTED.

HIS ENTIRE COMMUNITY WENT UP IN FLAMES.

BUT LOSING THEIR HOME WAS JUST THE BEGINNING OF THEIR HARDSHIPS.

SOON THEY WOULD FIND OUT THEY WERE SEVERELY UNDERINSURED.

AFTER MOVING FOUR TIMES AND THEIR KIDS ATTENDING THREE DIFFERENT SCHOOLS, THEY FINALLY MOVED BACK INTO THEIR NEW HOME IN NOVEMBER 2024.

DID INSURANCE COVER ALL OF YOUR LOSSES?

IN TOTAL, THEY SAY THEY PAID MORE THAN A MILLION DOLLARS OUT OF POCKET.

WE MET UP WITH THEM THIS SUMMER JUST A FEW MONTHS AFTER THEY MOVED IN.

THE NEW HOME IS ENERGY EFFICIENT AND MORE FIRE RESISTANT.

THE HOME IS STILL SPARSE BECAUSE THEY ARE SO IN DEBT FROM THE REBUILD.

MANU AND AMITA'S SITUATION WAS ALL TOO COMMON.

IN TOTAL, 74% OF THE VICTIMS OF THE MARSHALL FIRE WERE UNDERINSURED.

THAT MEANS THEIR INSURANCE POLICY DIDN'T COVER THE FULL EXTENT OF THEIR LOSSES.

TODAY, THIS STILL REMAINS A PROBLEM.

SOME STUDIES SUGGEST AT LEAST HALF OF HOMEOWNERS ARE UNDERINSURED.

THIS CAN HAPPEN FOR A VARIETY OF REASONS.

SAY YOU HAVE AN OUTDATED INSURANCE POLICY THAT DOESN'T FACTOR IN MAJOR HOME RENOVATIONS.

OR YOUR POLICY DOESN'T INCLUDE EXPENSIVE ITEMS LIKE ART OR JEWELRY.

OR YOU DIDN'T BUY SUPPLEMENTAL COVERAGE TO OFFSET INFLATION OR UNEXPECTED CONSTRUCTION COSTS.

SO, IN 2023, THE LEGISLATURE PASSED A BILL TO ADDRESS UNDERINSURANCE.

IT REQUIRES THE STATE TO CREATE AN ANNUAL REPORT ON REBUILDING COSTS AND REQUIRES INSURERS TO BE MORE UPFRONT ABOUT THOSE COSTS IN THEIR POLICIES.

INSURANCE COMPANIES ARE ALSO REQUIRED TO OFFER MORE ROBUST COVERAGE OPTIONS.

STATE SENATOR JUDY AMABILE OF BOULDER COUNTY WAS A MAIN SPONSOR OF THE BILL.

- PEOPLE DIDN'T KNOW THAT THEY WERE UNDERINSURED.

THEIR BROKERS WERE TELLING THEM, YOU KNOW, WHATEVER IT WAS, $250 A FOOT WAS ENOUGH TO REBUILD, AND IT WASN'T.

SO A BIG PART OF THE UNDERINSURANCE THING IS EDUCATING PEOPLE, BUT ALSO MAKING IT MORE CLEAR WHAT EXACTLY IT IS YOU'RE BUYING WHEN YOU BUY INSURANCE.

- BUT EVEN WITH MORE EDUCATION, FULL INSURANCE COVERAGE REMAINS OUT OF REACH FOR MANY COLORADANS.

- THEY'VE PROBABLY DOUBLED SINCE I'VE BEEN HERE.

AND I KNOW I'M UNDERINSURED AND MOST OF US ARE PROBABLY.

I JUST DON'T WANT TO PAY MORE EVERY MONTH.

OBVIOUSLY, IF MY HOUSE BURNED DOWN, I'D WISHED I HAD.

BUT - - YEAH.

- IT'S ALREADY PRETTY EXPENSIVE.

COLORADO IS NOW ONE OF THE TOP 8 STATES IN THE COUNTRY FOR HOMEOWNERS' INSURANCE RATES.

FROM 2007 TO 2024, RATES FOR COLORADANS WENT UP ALMOST 250%.

THAT'S ABOUT 100% MORE THAN WHAT HOMEOWNERS SAW NATIONALLY.

WE WANTED TO UNDERSTAND WHY COLORADO'S RATES HAVE BEEN INCREASING SO MUCH, SO WE MET WITH CAROL WALKER, AN INSURANCE INDUSTRY ADVOCATE.

- HOW HAS THE INSURANCE MARKET IN THE STATE CHANGED OVER THE LAST 20 YEARS?

- WE ARE IN THE MOST CHALLENGING PROPERTY INSURANCE MARKET THAT WE'VE SEEN IN A GENERATION.

WE HAVE THIS PERFECT STORM OF RECORD-BREAKING CATASTROPHES.

AT THE SAME TIME, WE HAVE SOME OF THE WORST MARKET CONDITIONS.

EVERYTHING THAT INSURANCE PAYS FOR TO REPAIR AND REBUILD YOUR HOME, FROM LABOR TO LUMBER IS MORE EXPENSIVE.

SO WHAT WE'VE REALLY SEEN PLAY OUT IN COLORADO IS UNFORTUNATELY, A LOT OF PRESSURE ON THE INSURANCE MARKETPLACE HERE WHICH PUTS PRESSURE ON THOSE INDIVIDUAL HOMEOWNERS.

COLORADO IS WHAT'S KNOWN AS A DUAL CATASTROPHE STATE BECAUSE OF THE FREQUENT WILDFIRES AND HAILSTORMS.

ALMOST A THIRD OF THE STATE'S COUNTIES ARE AT MODERATE TO HIGH RISK OF WILDFIRE.

ON TOP OF THAT, A LARGE SECTION OF THE STATE EXPERIENCES FREQUENT HAIL.

THAT LEAVES MANY COLORADANS VULNERABLE TO BOTH CATASTROPHES.

SINCE 1990, THE NUMBER OF WILDFIRES IN COLORADO HAVE INCREASED ALMOST TENFOLD.

THESE FIRES ARE ALSO MORE DESTRUCTIVE, CREATING LARGER AND MORE DENSE BURN SCARS OVER TIME.

AND THESE WEATHER EVENTS ARE GETTING MORE SEVERE.

THE SIZE OF HAIL HAS ALSO INCREASED OVER THE PAST 25 YEARS, AND RESEARCHERS ATTRIBUTE THIS TO CLIMATE CHANGE.

AND THOSE PELLETS OF ICE ARE ACTUALLY THE MAIN DRIVER OF RISING INSURANCE COSTS.

- THE AMOUNT OF PREMIUM THAT PEOPLE PAY ON AVERAGE ACROSS THE STATE IS COMPRISED ROUGHLY OF 60 TO 70% OF HAIL RISK.

AND THAT'S SOMEWHAT SHOCKING WHEN I HAVE THAT CONVERSATION WITH PEOPLE.

THEY DON'T REALIZE THAT THE HAIL THAT IS HITTING THEIR ROOF, THAT IS TAKING OUT THEIR ROOF, WHETHER IT MAYBE ONCE EVERY 10 YEARS OR MAYBE THREE TIMES IN THAT 10-YEAR PERIOD OF TIME, THAT IS WHAT IS REALLY DRIVING THEIR HOMEOWNERS' INSURANCE RATES UP.

TO GIVE YOU JUST KIND OF A FLAVOR OF THE DAMAGE THAT WE'RE TALKING ABOUT, SO THE MARSHALL FIRE BURNED FOR ABOUT TWO DAYS, AND IT TOOK OUT OVER 1,000 HOMES, AND FOR THOSE HOMES THAT WERE LOST, THAT WAS ABOUT A BILLION DOLLARS IN INSURANCE LOSSES.

TO GIVE YOU A COMPARISON, IN 2024, JUST LAST SUMMER, WE HAD TWO BIG HAILSTORMS THAT HIT THE STATE WITHIN A COUPLE OF WEEKS.

ONE HIT CENTRAL PARK.

ANOTHER ONE HIT NORTHEASTERN COLORADO.

THOSE TWO STORMS COMBINED, SO 40 MINUTES TO AN HOUR WORTH OF HAILSTORMS, IT WAS A BILLION DOLLARS' WORTH OF INSURANCE LOSS.

SO IT GIVES YOU A REAL KIND OF TANGIBLE WAY OF UNDERSTANDING HOW IMPACTFUL HAIL REALLY IS IN COLORADO.

(MUSIC PLAYING) WE WANTED TO SEE HOW A COMMUNITY RECOVERS FROM A BILLION DOLLAR HAILSTORM, SO WE TOOK A TRIP TO YUMA, A SMALL, CLOSE-KNIT FARMING AND RANCHING TOWN OF 3,500 PEOPLE.

- WELL, THIS IS ONE OF THE RESIDENCES THAT YOU CAN SEE THAT THE VINYL SIDING DIDN'T HOLD UP AT ALL.

- WOW, SOME THERE TOO.

AND YOU SAID ALMOST EVERY HOUSE LOOKED LIKE THAT?

- ALMOST EVERY HOUSE THAT HAS VINYL SIDING LOOKS LIKE THAT.

THAT'S KEVEN MEANS TOURING ME AROUND.

KEVEN WAS BORN AND RAISED IN YUMA.

LOOK AT THAT NEXT CORNER, ALL THOSE TREES ON THE LEFT.

- LOOK AT WHAT DID TO THESE BIG TREES.

- OH WOW, ONE SIDE'S COMPLETELY BARE.

KEVEN IS A LOCAL CONTRACTOR WHO HAS BEEN BUSY REPAIRING HOMES IN TOWN.

YUMA HAS HAD A NUMBER OF DAMAGING HAILSTORMS COME THROUGH OVER THE YEARS.

IN THE SUMMER OF 2023, THE BIGGEST HAILSTONE ON RECORD IN COLORADO WAS REPORTED HERE AT OVER FIVE INCHES, ABOUT THE SIZE OF A GRAPEFRUIT.

SO IT'S, I MEAN, HAILSTORMS ARE A PART OF LIVING IN THIS PART OF THE STATE.

- IT IS.

IT'S ONE OF THE NEGATIVES ABOUT LIVING IN THIS PART OF THE STATE.

BUT EVEN FOR A TOWN ACCUSTOMED TO HAILSTORMS, THE 2024 STORM WAS DIFFERENT.

PEOPLE IN YUMA CALLED IT A 100-YEAR STORM.

[HAIL HITTING ROOF] - OH MY GOD!

IT'S OKAY!

- DESCRIBE THE DAMAGE THAT MOST HOMES INCURRED DURING THE STORM.

- I WOULD SAY 99% OF ALL HOMES HAD TO HAVE THEIR ROOFS REPLACED.

ONE ESTIMATE THAT I HEARD THAT THERE WAS OVER 10,000 WINDOWS BROKE IN YUMA.

AND I THINK THAT'S LOW.

MOTHER NATURE WAS BRUTAL.

SHE WAS BRUTAL BECAUSE WE'RE GONNA LOSE AT LEAST 90-95% OF ALL EVERGREENS IN YUMA.

- IT'S BEEN OVER A YEAR SINCE THE HAILSTORM.

YOU'RE STILL REPAIRING HOMES.

WHY HAS IT TAKEN THIS LONG?

- THERE'S JUST SO MUCH TO DO.

- YEAH, COME OVER HERE.

- YOU CAN SEE HOW, HOW BIG THOSE STONES WERE, THE WAY THEY HIT.

AND IT DAMAGED THE SHUTTERS.

PRIOR TO THE HAILSTORM, THERE WERE A LOT OF PEOPLE GOT A LETTER FROM CERTAIN INSURANCE COMPANIES TELLING THEM THAT THEY WERE DROPPING THEIR INSURANCE, SAID WE'RE LEAVING THE STATE OF COLORADO BECAUSE WE CAN'T AFFORD ALL THIS.

AND I JUST TODAY, THERE WAS A LADY IN HERE AND I WAS TALKING TO HER.

SHE SAID HER INSURANCE POLICY HAS GONE UP $600 A MONTH.

- THIS BACKED UP WHAT WE'D HEARD FROM FOLKS IN TOWN.

- I'M A RETIRED TRUCK DRIVER AND FARMER.

THEY WANT LIKE $500 A MONTH FOR INSURANCE AND THAT'S AN AWFUL LOT.

- WHEN OUR INSURANCE RENEWED THIS YEAR, IT WENT UP ABOUT $2,000.

THAT WAS A BIG HIT.

MY BUSINESS WENT UP ABOUT $100 A MONTH.

- UNFORTUNATELY, THE COMPANY THAT WE WERE WITH HAS PULLED OUT OF YUMA, AND WE HAVE TO FIND NEW INSURANCE, WHICH HAS PROVED TO BE VERY DIFFICULT BECAUSE OF ALL THE CLAIMS THAT WE'VE HAD FROM THAT STORM.

I WOULDN'T BE SURPRISED IF THERE'S NO INSURANCE PRETTY SOON.

THAT'S ALREADY A REALITY IN POCKETS OF COLORADO.

IN SOME COMMUNITIES AROUND THE FRONT RANGE AND EASTERN PLAINS, INSURANCE COMPANIES HAVE PULLED OUT.

- WE DID HAVE ONE COMPANY DROP US AND THEN WE HAD TO FIND ANOTHER INSURANCE COMPANY, WHICH WASN'T A PROBLEM, BUT NOW THAT POLICY IS COMING UP FOR RENEWAL.

AND I'VE TALKED TO A LOT OF PEOPLE UP HERE THAT HAVE SAID, "OUR INSURANCE COMPANIES ARE DROPPING US."

- FOR THE PREVIOUS COMPANY THAT DROPPED YOU, WHAT WAS THEIR REASONING OR HOW DID THAT GO?

- BASICALLY IT WAS JUST, WE'RE NOT RENEWING YOUR POLICY.

WE DIDN'T GET ANY KIND OF REASON THAT I KNOW OF.

- A NUMBER OF COMPANIES HAVE CALLED, "INELIGIBLE ZIP CODE LISTS," THAT SIMPLY SAY, IF IT'S IN THE ZIP CODE, THIS AREA, WE ARE NOT WRITING THAT HOME.

THIS ONE'S ACTUALLY ALLSTATE.

YOU CAN SEE THIS IS, YOU'VE GOT THREE COLUMNS OF ZIP CODES.

YOU'RE SIMPLY INELIGIBLE TO BE WRITTEN IN IN ANY OF THOSE PARTICULAR AREAS.

YOU CAN SEE AGAIN BOULDER, THERE'S THAT 80304, NEDERLAND IS IN THERE.

AS MORE AND MORE PARTS OF COLORADO HAVE BECOME AN INSURANCE DESERT, STATE LAWMAKERS LIKE JUDY AMABILE DECIDED TO TAKE ACTION.

- MAYBE 2 YEARS AGO, WE ALL STARTED TO HEAR, "OH, THIS INSURANCE COMPANY ISN'T GOING TO INSURE HOUSES IN THIS NEIGHBORHOOD."

AND IT BECAME CLEAR THAT WE WERE GONNA HAVE NEIGHBORHOODS WHERE NO ONE IS WILLING TO INSURE.

AND SO, TWO YEARS AGO WE RAN A BILL TO SET UP THIS FAIR PLAN AND THAT IS AN INSURER OF LAST RESORT.

AS OF DECEMBER 2025, ABOUT 140 PLANS HAD BEEN ISSUED TO HOMEOWNERS AND BUSINESSES ACROSS MORE THAN HALF OF THE STATE'S COUNTIES.

TO QUALIFY, THE HOME MUST BE CONSIDERED UNINSURABLE AND REJECTED BY AT LEAST THREE COMPANIES.

AND THE PLAN IS VERY BARE BONES.

IT DOESN'T PAY OUT AS MUCH AS A STANDARD PLAN AND MAXES OUT AT $750,000 REGARDLESS OF THE COST OF REBUILDING.

AND PREMIUMS ARE SIGNIFICANTLY HIGHER THAN STANDARD PLANS.

- TO BETTER UNDERSTAND HOW THE FAIR PLAN WORKS, INSURANCE BROKER STEVE HAKES WALKED US THROUGH A QUOTE.

- IT'S A GOOD HOUSE, IT'S A NEWER HOUSE, A BUILD YEAR OF 2022, SQUARE FOOTAGE OF A LITTLE OVER 1,800.

I RAN A COST ESTIMATOR.

IT WOULD COST ALMOST $500,000 TO REBUILD THIS HOME.

THIS IS COLORADO FAIR PLAN QUOTE HERE.

EVEN AT A 2022 BUILT HOME, IT'S PUTTING THE ACTUAL CASH VALUE, THEY'RE SAYING THEY WOULD ONLY PAY UP TO $373,000 FOR IT WHICH IS VERY CRAZY LOW.

- IT'S NOT A PERFECT SOLUTION, BUT IT IS MEANT TO BE A BACKSTOP ON THE SITUATION THAT IS EVOLVING.

WHEN WE STARTED WITH THE FAIR PLAN, OUR HOPE WAS THAT NO ONE WOULD EVER NEED IT.

BUT WE'RE ALREADY SEEING THAT PEOPLE DO NEED IT AND I WOULD EXPECT THAT NUMBER WILL GROW DRAMATICALLY IN THE NEXT FEW MONTHS AS PEOPLE HEAR ABOUT THE FAIR PLAN AND AS MORE INSURANCE COMPANIES START TO TURN PEOPLE DOWN.

THE FAIR PLAN ISN'T THE ONLY WAY TO STAY INSURED IN A HIGH-RISK AREA.

WE TRAVELED TO LYONS, AN AREA OUTSIDE OF BOULDER, TO MEET WITH NICK AND ERICA.

HI, I'M BENTE.

NICE TO MEET YOU.

-HI BENTE.

-THANKS FOR HAVING US.

-COME ON IN.

-THANKS.

- WE'VE BEEN HERE ABOUT 30 YEARS.

WE'VE LOVED THE LANDSCAPE, AND THAT WAS, OF COURSE, BEFORE THERE WAS AS MUCH IMPACT OF CLIMATE CHANGE, AND SO WE DIDN'T EVEN HAVE A SENSE THEN THAT WE WOULD EVER BE AT RISK.

THEY SAID IT WAS AN IDEAL PLACE TO RAISE THEIR CHILDREN, AND AS HOMEOWNERS, THEY HAD VERY FEW ISSUES OVER THE YEARS.

BUT THEN IN DECEMBER 2023, NICK AND ERICA GOT A SURPRISING LETTER.

- THEN WE GOT THE LETTER FROM OUR INSURANCE COMPANY THAT SAID, WE WILL NOT RENEW YOUR INSURANCE BECAUSE OF THE RISK OF WILDFIRE.

AND SO OF COURSE WE PANICKED.

AND THAT'S WHEN WE STARTED WORKING WITH WILDFIRE PARTNERS.

WILDFIRE PARTNERS IS A PROGRAM RUN BY BOULDER COUNTY THAT HELPS HOMEOWNERS PROTECT THEMSELVES AGAINST FIRES.

THEY GUIDED THE COUPLE ON WAYS TO MITIGATE THEIR PROPERTY.

- OUR HOUSE IS A WOODEN HOUSE WITH CEDAR SIDING AND WOODEN DECKS.

THIS IS NOT A GREAT SITUATION.

AND SO, OUR HOUSE IS VERY VULNERABLE TO FIRE IN MANY DIFFERENT WAYS.

THIS USED TO BE BRUSH AND SO WE'VE CUT A LOT OF IT BACK AND REPLACED A LOT OF IT WITH GRAVEL AND ROCKS.

THIS AREA WE HAD TO CLEAR THE BRUSH ALL THE WAY DOWN BECAUSE FIRE MOVES MUCH MORE QUICKLY COMING UP THESE SLOPES AND SO THIS WHOLE AREA WHICH HAD BEEN COVERED WITH BRUSH, WE HAD TO CLEAN ALL OF IT OUT AND BRING IT DOWN TO GRASS AND THEN CUT THE GRASS DOWN.

- AND ALL THE WAY DOWN IN THAT DIRECTION, WE ELIMINATED BRUSH.

TO MITIGATE THEIR HOME, NICK AND ERICA ESTIMATE THEY SPENT MORE THAN 100 HOURS AND $10,000.

- OUR PROPANE TANK NOW IS FULLY MITIGATED.

OUR PERIMETER HERE OF NON-BURNABLE FUEL.

BEFORE WE DID THE MITIGATION, THERE WAS A BRUSH THAT WAS GROWING UP ALL AROUND THE PROPANE TANK.

- WHAT WERE WE THINKING?

- WHAT WERE WE THINKING?

AND THAT MARCH OF 2024, NICK AND ERICA GOT GOOD NEWS.

WILDFIRE PARTNERS GAVE THEM THEIR STAMP OF APPROVAL AND THE INSURANCE COMPANY RENEWED THEIR POLICY.

- WE ARE CONTINUING TO LOOK AT THE TWO FIRES THAT ARE BURNING-- AND THEN JUST A FEW MONTHS LATER, IT WAS AN UNBELIEVABLE TURN OF EVENTS - A WILDFIRE RIPPED THROUGH THEIR COMMUNITY.

- AND MORE RESIDENTS IN LYONS HAVE BEEN TOLD THEY NEED TO EVACUATE.

THIS WAS THE FIRST TIME IN THEIR 30 YEARS OF LIVING HERE THAT FIRE HAD GOTTEN THIS CLOSE.

IT WAS ALSO THE FIRST TIME THEY WERE PREPARED.

- YOU CAN SEE HOW IT'S JUST RUNNING RIGHT UP THAT, AND THESE BUSHES HAVE SO MUCH FUEL IN THEM.

IMAGINE IF WE'D HAD THAT LEVEL OF FUEL RIGHT NEXT TO THE HOUSE.

AND THE FIRE, WE HAVE NO IDEA FROM THIS CAMERA, BUT IT WENT ALL AROUND ALL SIDES OF THE HOUSE AND THEN AS IS IT GETS CLOSER AND CLOSER AND CLOSER IT RUNS OUT OF FUEL.

THIS IS A DRONE SHOT FROM A WEEK OR SO AFTER THE FIRE THAT REALLY SHOWS HOW THE HOUSE HAS SURVIVED AND THE GARDEN AROUND IT BUT FROM ALL OTHER DIRECTIONS, THE FIRE APPROACHED THE HOUSE BUT RAN OUT OF FUEL AS IT GOT CLOSER.

- THE MITIGATION WE HAD DONE ACTUALLY REALLY WORKED.

- AND SO IT WAS A REAL, SUCH A SUCCESS STORY FOR WHAT WILDFIRE PARTNERS HAD DONE FOR US.

- SO THE FIRST THING THAT I'M SEEING HERE ACTUALLY IS THIS GAP RIGHT HERE.

IN BOULDER COUNTY, WILDFIRE PARTNERS HAS PERFORMED OVER 4,000 HOME ASSESSMENTS.

THAT'S US WITH OUR WILDFIRE PARTNER CONSULTANT ROB IN FRONT OF OUR NOT- BURNED-OUT HOUSE.

IN NICK AND ERICA'S COMMUNITY, ALL 13 HOMES THAT MITIGATED SURVIVED THE STONE CANYON FIRE.

THE OTHER FIVE WENT UP IN FLAMES.

- NOW MITIGATION DOESN'T GUARANTEE SURVIVAL, BUT MITIGATION WILL INCREASE THE ODDS.

SO WE'LL BE FILLING THESE DUMPSTERS TODAY WITH COMBUSTIBLE MATERIAL TO GET IT OUT FROM AROUND THE HOME AND HAULED OFF SITE AND REDUCE THAT FIRE RISK.

- WHAT DO YOU THINK IS THE BIGGEST DRIVER FOR PEOPLE NOT DOING THIS MITIGATION WORK?

- A LOT OF PEOPLE WILL SAY, IT'S NOT GOING TO HAPPEN TO ME, SO NOT UNDERSTANDING THE CHANGE IN OUR CLIMATE AND THE INCREASED RISK, BUT A LOT OF IT IS PROCRASTINATION.

WE CAN ALWAYS SAY WE'LL DO THAT TOMORROW OR NEXT MONTH OR NEXT YEAR.

IF YOU SPEND TIME UP FRONT, YOU MAY THINK THAT IT'S EXPENSIVE, BUT IT'S A FRACTION OF THE COST OF REBUILDING A HOME.

AND HERE'S YOUR CHECKLIST.

PART OF THE SUCCESS OF BOULDER'S PROGRAM HAS BEEN THE COLLABORATION WITH THE INSURANCE INDUSTRY.

BOULDER WAS THE FIRST COUNTY IN THE STATE TO OFFER CERTIFICATES FOR HOMEOWNERS WHO COMPLETED MITIGATION WORK AND THOSE CERTIFICATES HAVE BEEN CRITICAL FOR INSURANCE.

WHAT'S BEEN THE BUY-IN WITH THE INSURANCE INDUSTRY ON THIS?

- WE HAD A LOT OF SUCCESS IN 12 YEARS WITH INSURANCE COMPANIES RECOGNIZING THAT CERTIFICATE.

IT'S NOT A GUARANTEE, BUT IT REALLY HELPS HOMEOWNERS OBTAIN OR RETAIN INSURANCE.

AND INSURANCE COMPANIES ARE GOING TO WANT TO SEE THAT THE MITIGATION CONTINUES BECAUSE MITIGATION IS NOT A ONE-TIME ACTIVITY.

IT'S SOMETHING WE HAVE TO CONTINUE TO DO YEAR AFTER YEAR.

FOR POLICYMAKERS, MITIGATION IS FRONT AND CENTER AND A CRITICAL TOOL TO LOWERING COLORADO'S SKYROCKETING INSURANCE COSTS.

- TODAY I'M CALLING FOR NEEDED REFORMS TO TACKLE THE HIGH COST OF HOMEOWNERS INSURANCE AND LOOKING AT RISK REDUCTION EFFORTS THAT CAN DIRECTLY TRANSLATE TO LOWER COSTS FOR EVERYONE.

SO WE NEED STRATEGIES FOR BOTH HAIL AND FIRE.

AND THE LEVERS WE HAVE, HAIL PROOF ROOFS, FIRE RISK MITIGATION, THESE WILL BRING DOWN INSURANCE RATES AND OVERALL, THAT DRIVES DOWN RATES FOR EVERYBODY.

THE GOVERNOR RECENTLY ADVOCATED TO CREATE A GRANT PROGRAM TO HELP MORE HOMEOWNERS AFFORD THE COST OF HAIL RESISTANT ROOFS.

- AT THE END OF THE DAY, THE MORE HAIL PROOF ROOFS WE HAVE, ESPECIALLY IN THE EASTERN FRONT RANGE, AURORA, EAST DENVER, ETCETERA, THE LOWER RATES ARE GOING TO BE FOR EVERYBODY.

BUT HOW TO PAY FOR THEM HAS BEEN THE STICKING POINT.

THE BILL FAILED IN 2025 AND THE GOVERNOR WILL BE TRYING AGAIN THIS LEGISLATIVE SESSION.

IN YUMA, WHERE THE HAIL RISK IS HIGH, IT'S STILL AN UPHILL BATTLE TO GET EVERYONE IN TOWN TO BUY THE MORE EXPENSIVE HAIL RESISTANT SHINGLES.

- EVEN THOUGH I WAS PUSHING TO DO THE CLASS 4 ROOFS, YOU CAN ONLY ADVISE THEM SO MUCH, AND THEY HAVE TO MAKE THE DECISION.

- HOW MUCH MORE IS IT TYPICALLY TO PUT THAT HIGHER GRADE SHINGLE ON?

- IT'S USUALLY ABOUT $50 TO $60 A SQUARE HIGHER.

WHILE THE STATE FAILED TO PASS A BILL TO OFFSET THE PRICE OF HAIL RESISTANT ROOFS, LAWMAKERS DID TAKE SOME STEPS ON THE WILDFIRE FRONT.

COLORADO PASSED A LAW IN 2025 REQUIRING INSURANCE COMPANIES TO BE MORE TRANSPARENT ABOUT HOW THEY CALCULATE RATES IN WILDFIRE PRONE AREAS.

AND COMPANIES MUST EXPLAIN TO HOMEOWNERS WAYS TO MITIGATE TO LOWER THEIR WILDFIRE RISK AND POTENTIALLY LOWER THEIR RATES.

- WE ABSOLUTELY HAVE TO DO SOMETHING ABOUT RISING INSURANCE COSTS.

IT IS REALLY UNTENABLE IN A POINT IN TIME WHEN WE ARE ALL JUST REALLY WORRIED ABOUT THE PRICE OF HOUSING AND THE AFFORDABILITY OF HOUSING.

AND WE HAVE TO, WE HAVE TO FIX IT.

BUT LAWMAKERS LIKE AMABILE ARE WEARY OF PUTTING TOO MANY MANDATES ON INSURANCE COMPANIES.

- ALL OF THIS LEGISLATION HAS BEEN RUN IN A WAY THAT IS COOPERATIVE WITH THE INSURANCE INDUSTRY BECAUSE THEY HAVE TOLD US IF YOU PUSH TOO HARD, WE CAN'T STAY IN THIS MARKET.

WE WANT TO STRIKE THE RIGHT BALANCE BETWEEN HAVING A ROBUST INDUSTRY THAT TREATS PEOPLE WELL, AND THAT DOES WHAT THEY SAY THEY'RE GOING TO DO, AND HAVING THE RIGHT PROTECTIONS IN PLACE.

(MUSIC PLAYING) WHILE THE STATE CONTINUES TO FIGURE OUT A SOLUTION FOR THE FUTURE, SOME HOMEOWNERS ARE TAKING MATTERS INTO THEIR OWN HANDS.

THEY'RE DOING WHAT THEY CAN RIGHT NOW.

- WE LOOK AT THE PICTURES BEFORE, AND WE JUST HAVE THIS REACTION OF: WHAT WERE WE THINKING?

IT'S JUST HORRIFYING TO REALIZE THE RISKS THAT WE WERE TAKING AND SURE IT WAS A LOT OF WORK.

BUT WE DID IT AND WE HAVE TO PRESERVE IT.

BUT THE HARD WORK, THE HARD WORK IS DONE.

- SPEAK FOR YOURSELF.

I'M STILL OUT WEED WHACKING.

[LAUGHING]

Preview: 1/8/2026 | 30s | The state’s looming home insurance crisis puts pressure on homeowners. (30s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

RMPBS Original Documentaries is a local public television program presented by RMPBS