Here and Now

US Sen. Ron Johnson on a 2025 Tax Bill and the Federal Debt

Clip: Season 2300 Episode 2347 | 11m 21sVideo has Closed Captions

Ron Johnson on a 2025 reconciliation policy bill cutting federal taxes and spending.

U.S. Sen. Ron Johnson, R-Wisconsin, discusses his objections to a 2025 reconciliation policy bill cutting federal taxes and spending due to its projected $2.4 trillion increase to the national debt.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Here and Now is a local public television program presented by PBS Wisconsin

Here and Now

US Sen. Ron Johnson on a 2025 Tax Bill and the Federal Debt

Clip: Season 2300 Episode 2347 | 11m 21sVideo has Closed Captions

U.S. Sen. Ron Johnson, R-Wisconsin, discusses his objections to a 2025 reconciliation policy bill cutting federal taxes and spending due to its projected $2.4 trillion increase to the national debt.

Problems playing video? | Closed Captioning Feedback

How to Watch Here and Now

Here and Now is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship>> Elon Musk calls it an "abomination," Democrats hate it, and some Republican US senators are blasting its spending.

The federal reconciliation budget bill is taking it from all sides, even as President Donald Trump and the House speaker praise it as "big and beautiful."

According to the Congressional Budget Office, the House reconciliation bill will add $2.4 trillion to the federal debt over 10 years.

That's after cutting spending by 1.2 trillion, and decreasing revenues by 3.6 trillion.

Those numbers add up in a bad way according to Wisconsin Republican US Senator Ron Johnson, who joins us now from Washington.

And Senator, thanks very much for being here.

>> Well, Frederica, hope you're doing well.

>> I am.

So, are you still a hard no on the reconciliation bill in its current form, even after talking to President Trump?

>> In its current form, but let me point out the good parts of the bill.

Would take away, eliminate a massive automatic tax increase on virtually every American that pays tax.

It certainly avoids default.

The House has done some pretty good work at looking at programs, you know, trying to eliminate the waste, fraud and abuse of the Obamacare portion of Medicaid.

That's necessary to do so we can protect the benefits for the vulnerable, for disabled children, pregnant women, the people that Medicaid was actually designed for.

Not single, able-bodied, working age childless adults.

So again, the House has done a lot of good work.

You know, my main beef is the debate in the House was pretty lacking in terms of looking at the numbers we really need to be looking at.

They throw out, you know, 1.5 trillion.

Sounds like a lot, but over 10 years it's barely a rounding error in the $89 trillion was spent and the $22 trillion additional deficit.

Which, again, we can argue, I'm not a big fan of the CBO scores, their static scoring versus dynamic.

But, you know, set the score aside, look at the 10 year projection, it is pretty grim.

And so, my main point is we have to look at the facts and figures.

Our goal should be to bend the deficit curve down.

Right now, it continues to skyrocket.

But again, the good news is I think we've got good people in the positions.

I respect the president.

I know he wants to tackle this problem.

The speaker, Leader Thune, Chairman Crapo.

President's got a first class economic team.

So, my next step is sitting down with Secretary Bessent again and going through the numbers.

Let's get our facts straight.

Let's get on the same page from that standpoint.

Then, you know, figure out how we can do something that's really hard.

You know, one of the points the president made in the meeting is, you know, Democrats are always so unified.

And I point out, well, that's because they're doing the easy thing.

They're spending money.

They're mortgaging our kids' future.

It is hard to be the parent, it's easy to be the parent that says, "Hey, we're gonna go to Disney World."

It's hard to be the parent who says, "We can't afford that.

I know we all want to go to Disney World.

We just can't afford that."

We're kind of in that position right now.

We're trying to rein in all this massive deficit spending, trying to restrain the growth in the deficits.

>> Elon Musk calls this a "massive, outrageous, pork-filled, disgusting abomination."

Is that too strong then?

>> Well, the spending is on some pretty necessary items.

You know, the top priority of government is defense, so it spends more on defense.

Realizing that we're probably gonna have a hard time passing appropriation bills, probably operating on a continuing resolution for the next fiscal year.

And also recognizes we have to secure the border.

And we do need to deport criminals, and members of violent gangs, and human sex and drug traffickers.

So, there is some funding we have to provide.

Otherwise, there are some real spending reductions here.

Again, not enough to solve our problem.

And that's all I'm pointing out is we have to look at that problem.

We have to continue to highlight it.

We have to lead, and we have to lead about doing something that's really hard.

>> If adding $2.4 trillion to the national debt is irresponsible, in your mind, as I've heard you say, why not dial back the tax cuts?

>> It's not tax cuts.

It's preventing a tax increase.

And it is true, the Tax Cut and Jobs Act, when we enacted that, federal revenue was 17.1% of our economy.

Right now, federal revenue is 17.1% of our economy.

So, we actually lowered rates and we're still taking in over 10 years now the same percentage of GDP.

And what is interesting is no matter how much you try punishing success, and I've got a great chart, it goes back, I think, more than 50 years, showing top marginal tax rate of 91%, 70%, 50%, again, we spent all over the place.

But over 50 years, the average revenue we've been able to extract from the American economy, the American people, 17.1%.

So, we're at that average.

At some point in time, we need to recognize that reality.

Recognize that the top 1%, yeah, they earn 20% of the income, they pay more than 40% of the tax.

At some point, you have to realize that's probably a fair share.

We've got progressive rates.

So again, I'm not into raising people's taxes that would harm the economy.

Recognizing that economic growth is the number one component to try and get ourselves out of this deep hole that we dug.

>> Would you be looking for deeper cuts to social safety net programs?

Is that a place you could find savings, even looking for cuts in Medicare?

>> No, what I've been pointing out is COVID created a massive surge in federal government spending.

We were spending $4.4 trillion in 2019.

This year we'll spend in excess of $7 trillion.

That's a 58% increase.

No Wisconsin family, if they had an illness had to borrow $50,000 to pay medical bills.

If that family member got well, will keep borrowing $50,000 and spend at that level.

But that's exactly what Joe Biden, the Democrats did following COVID.

Totally irresponsible, totally unsustainable.

So again, I've been just saying, let's return to a reasonable pre-pandemic level.

I've laid out options.

Clinton, in 1998, Obama in 2014, Trump in 2019.

You exempt Social Security, Medicare and interest.

Spend what you need to spend, but all other outlays, actual outlays, increased by population growth, inflation, you end up with a baseline budget of somewhere between 5.5 and $6.5 trillion.

That's a reasonable approach.

It's a reasonable control.

So, that's basically looking at spending across the board.

Line by line.

That's what I've been suggesting and pretty well requiring, is we need a process to control spending.

Go line by line.

Program by program.

There's over 2,600 programs in the federal government.

My belief is we could eliminate hundreds of those programs, probably eliminate hundreds of billions of spending that nobody would even notice except for the grifters who are sucking down the waste, fraud and abuse.

>> What kinds of cuts to this discretionary spending, because I'm sure you've looked at this, line by line, or at least started to?

What kinds of discretionary spending would you have an eye on?

>> Again, it's across the board.

I would take a look at any spending program.

When you plus it up from 2019 or, I laid out all the options.

You know, what did we spend under Clinton?

Totally plussed up.

What about Obama?

What about Trump?

I have those three figures in front of me.

And then I'd say, well, what are we spending today?

Well, why are we 10 or 15% above even 2019 levels?

Again, in a business, this would be easy.

I would go to my managers and say, "Listen.

I told you guys you could increase your budgets based on inflation and the number of customers you serve.

Why are you 10% above that?

Cut it.

I'm not quite sure how you do it.

I don't care.

Don't harm our customers, don't harm our employees, but cut your budget."

That would be a five minute conversation, and it would be done.

It ought to be that easy for the federal government.

Unfortunately, it's not.

>> What about clawing back money already appropriated, like in the rescission package that just went to Congress, that cuts $9.4 billion from USAID and PBS and NPR?

Bearing in mind that we're sitting in a PBS station right now conducting this interview.

But, I trust you'll vote yes on that first precision package?

>> I completely support what President Trump and Elon Musk did with DOGE.

They exposed just grotesque examples of waste, fraud and abuse.

Again, we're $37 trillion in debt.

We have deficits, you know, projected to average $2.2 trillion over the next 10 years.

You need to start eliminating spending.

And so you just can't afford this anymore.

Again, we can't go to Disney World.

We simply can't afford it.

>> And so you would like to see all the DOGE cuts codified in the way of a rescission package?

>> Yeah.

Again, I can't say every last one of them, but I would be generally supportive.

And again, that's pretty much up to the White House.

They have to propose, you know, prepare those rescission packages and then, you know, we get an up or down vote on it.

>> As it stands, the House bill, according to the Congressional Budget Office, nearly 11 million people would lose their Medicaid or Affordable Care Act coverage under the bill, would you want to shed more people?

>> Well, first of all, that's where you start really criticizing CBO score.

People are pointing out there are a lot of partisans in that, so they're gonna, you know, ramp those numbers up, scare people.

A lot of those people losing maybe Medicaid coverage, hopefully, with the work requirements, will be gaining coverage under their employer.

Again, you have to understand, Frederica, for every dollar a state spends on traditional Medicaid for disabled children, for pregnant women, the vulnerable, the federal government kicks in a $1.33.

For every dollar the state spends on an able-bodied, working age childless adult, we spend $9.

That distortion has allowed states and providers to completely abuse the system.

Has caused Medicaid costs to skyrocket, putting at-risk Medicaid for the vulnerable.

So again, we've got to fix that.

Again, that's why I opposed Obamacare.

I knew it would screw things up, and it has now states and healthcare providers have had pretty well figured out how to game the system.

Medicaid now reimburses providers at two or three times the rate of Medicare because they've been able to game the system because that disparity between what the federal government kicks in for an able-bodied, single, childless adult.

Again, this is absurd.

The American people don't support that, if they know about it.

>> What about the Trump administration's tariffs?

What is your position on those at this point?

>> Well, again, I'm pretty much an unabashed free trader.

I realize that there are products that we've allowed to be offshore that are strategic.

We've got to bring them back.

I know that China is a real abuser of world trading organizations.

Now, President Trump has a negotiating strategy.

I really don't want to reduce his leverage in that.

I do hope that he concludes it and we, you know, come to some, you know, steady points so we can return certainty and stability to our economy.

>> All right.

Senator Ron Johnson, we leave it there.

Thanks very much for your time.

>> Have a great day.

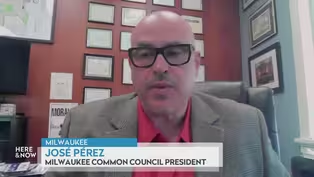

Alderman José Pérez On ICE Arrests of Milwaukee Immigrants

Video has Closed Captions

Clip: S2300 Ep2347 | 5m 55s | José Pérez on community support for residents of Milwaukee who were detained by ICE. (5m 55s)

Here & Now opening for June 6, 2025

Video has Closed Captions

Clip: S2300 Ep2347 | 1m 4s | The introduction to the June 6, 2025 episode of Here & Now. (1m 4s)

Kurt Kotenberg On Tracking Wildfire Smoke Across Wisconsin

Video has Closed Captions

Clip: S2300 Ep2347 | 7m 8s | Kurt Kotenberg on wildfire smoke in Wisconsin and the potential for such conditions. (7m 8s)

Moore, Pocan Seek To Visit ICE Detainees At Juneau Facility

Video has Closed Captions

Clip: S2300 Ep2347 | 1m 53s | Gwen Moore and Mark Pocan visit an ICE detention facility after an immigrant was framed. (1m 53s)

Wisconsin Native Languages Shift From Silence To Celebration

Video has Closed Captions

Clip: S2300 Ep2347 | 7m 29s | A movement to revitalize Indigenous languages is taking root across Wisconsin. (7m 29s)

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship

- News and Public Affairs

Top journalists deliver compelling original analysis of the hour's headlines.

- News and Public Affairs

FRONTLINE is investigative journalism that questions, explains and changes our world.

Support for PBS provided by:

Here and Now is a local public television program presented by PBS Wisconsin