Using Your Credit—Crazy or Compelling?

Season 1 Episode 115 | 29m 49sVideo has Closed Captions

Learn about the true cost of purchasing with credit.

Don’t live on borrowed time. Join the Biz Kids and you’ll see the true cost of purchasing with credit. You’ll also have an unsettling look at credit scores and the increasing number of people and places (employers, insurers, colleges, etc.) who are using these scores to make major decisions that could affect your future. Meet entrepreneurs who have successfully navigated credit pitfalls.

Problems playing video? | Closed Captioning Feedback

Problems playing video? | Closed Captioning Feedback

Biz Kid$ is presented by your local public television station.

Distributed nationally by American Public Television

Using Your Credit—Crazy or Compelling?

Season 1 Episode 115 | 29m 49sVideo has Closed Captions

Don’t live on borrowed time. Join the Biz Kids and you’ll see the true cost of purchasing with credit. You’ll also have an unsettling look at credit scores and the increasing number of people and places (employers, insurers, colleges, etc.) who are using these scores to make major decisions that could affect your future. Meet entrepreneurs who have successfully navigated credit pitfalls.

Problems playing video? | Closed Captioning Feedback

How to Watch Biz Kid$

Biz Kid$ is available to stream on pbs.org and the free PBS App, available on iPhone, Apple TV, Android TV, Android smartphones, Amazon Fire TV, Amazon Fire Tablet, Roku, Samsung Smart TV, and Vizio.

Providing Support for PBS.org

Learn Moreabout PBS online sponsorship>> Production funding and educational outreach for Biz Kids is provided by a coalition of America's credit unions, where people are worth more than money.

A complete list of individual credit union funders is available at wxxi.org.

>> Every day, America's credit unions help members with their financial needs and with programs like Invest in America.

It's only fitting that credit unions support Biz Kids because financial education is what we do.

Learn more at lovemycreditunion.org.

>> Cash is pretty simple.

With cash, this is how much you have, so this is how much you have to spend.

Credit, on the other hand, can be a little more tricky.

>> What's so trick about it?

It's just a card.

>> Well, for one thing, with credit, you have a little bit more purchasing power.

>> Power!

>> You're right.

I can feel it.

I have the power!

The power to spend more money than I actually have.

>> But with power comes responsibility.

Credit can be a pretty powerful tool.

>> That's right.

>> But if you abuse it, there's trouble ahead.

( pop ) >> Ow.

( popping ) >> ♪ When making money is the aim ♪ These kids they bring their game ♪ They're the Biz Kids Can you dig it?

♪ They know what's up and let you know ♪ Just how to make that dough ♪ They're the Biz Kids Right on ♪ So learn a little more about bringing money through the door ♪ They're the Biz Kids Right on.

♪ >> Most everyday things can and should be bought with cash.

You don't want to rack up a credit card balance on lattes, CDs, and movie tickets.

>> But some things require more purchasing power than if you just used the cash you have on hand.

>> Like a car or a loan for college and later a house.

>> Remember, when you use credit, you're not only paying for the item; you're paying for the use of other people's money.

>> The upside is you can buy things you couldn't normally afford.

The downside is the true cost is higher than if you just paid with cash.

>> And the way you pay off that credit has a big effect on your financial future.

>> The point is credit is a powerful tool.

>> And like other powerful things, handle with care.

>> Credit!

What's in your billfold?

>> ...dresses can be yours with 12 easy credit payments.

>> Hi, I'm Monica, and I design iPod cases, and I'm a Biz Kid.

My parents and I moved over here about six years ago with almost nothing.

>> Este-- Hay cinco anos nosotros venimos de El Salvador.

>> Five years ago, I come de El Salvador.

I come for this country because this is the American dream.

The advice for my daughter especially using the credit card... >> ...pay your credit card on time.

>> I never dreamed that I would start my own business, but then I discovered BUILD.

"BUILD" stands for Business United-- wait, hold on.

Through BUILD, I discovered that many people needed iPod cases.

>> I got these shoes yesterday and thought, "Wouldn't the perfect accessory be a great colored iPod case?"

>> I need to dress my iPod with iWear's fabulous cases.

>> So me and my friends decided to start a business that would provide the customers with affordable iPod cases.

>> It's too much.

>> But if you buy this anywhere else, you know, it's going to cost more.

When we started our business, we didn't trust credit, and we didn't have credit, and we didn't have enough money to actually start it.

So we ended up going to a Visa advisor and getting funding.

>> The venture capitalists gave them advice on how they could get a loan if they improved their business plan.

And they went back to the drawing board again and again, and they improved their presentation skills and their written business plan, so they did get the money that they needed.

>> We used credit very carefully.

There's only two people in the team that are allowed to sign checks and who make all the payments.

>> They're proving to the adults that they can keep their own income statements, they can get their own seed money, and then they can continue and perpetuate and be successful at business.

>> I make sure that our cases are fashionable and to our customers' satisfaction.

>> I supervise prototype-making process to maximize our productivity.

>> I make sure our case designs are fabulous.

>> We use just-in-time processes to make sure that our manufacturing runs smoothly with no mix-ups.

>> They're a very successful business today, and they sell on campus very often.

>> These are my models, and I'm only selling them for $12.

>> What, 12 bucks?

>> Yes.

>> I got to get one of these.

>> Credit cards can be useful for business in the beginning, but they should not be relied on.

>> In one hand, credit is a good thing because you get to buy your stuff and buy things that you need.

In the other hand, it's a bad thing, because you end up... if you're not careful, you end up paying more than you need to.

>> Credit cards should only be used for good, okay?-- instead of evil.

>> A Biz Kid knows when to use a credit card for good, not for evil.

>> Okay, so here's what credit is all about.

Have you saved up enough money to buy that car yet?

>> Not exactly.

I have about half of what I need.

But the problem is I have to have a new car for my new job.

>> Okay, so you don't have the money, but Alex does.

So Alex is going to lend you the money.

Now, here's the thing.

You're going to pay Alex back on a monthly basis, with an extra fee tacked on for using his money.

So now you have your car.

Happy?

>> Yeah, totally.

>> And you understand that the total cost is more now because you're actually paying Alex to use his money.

>> Absolutely.

>> And this guy's happy because his money has made some money.

So those are the basics.

Everybody wins.

If only it could be that simple in real life.

>> Miriam, this is real life.

>> You see, when you make a purchase, there are these extra numbers.

And numbers, that's called interest.

Wow, you paid a lot of interest.

>> This is the story of the tortoise and the... >> Are You Interested?

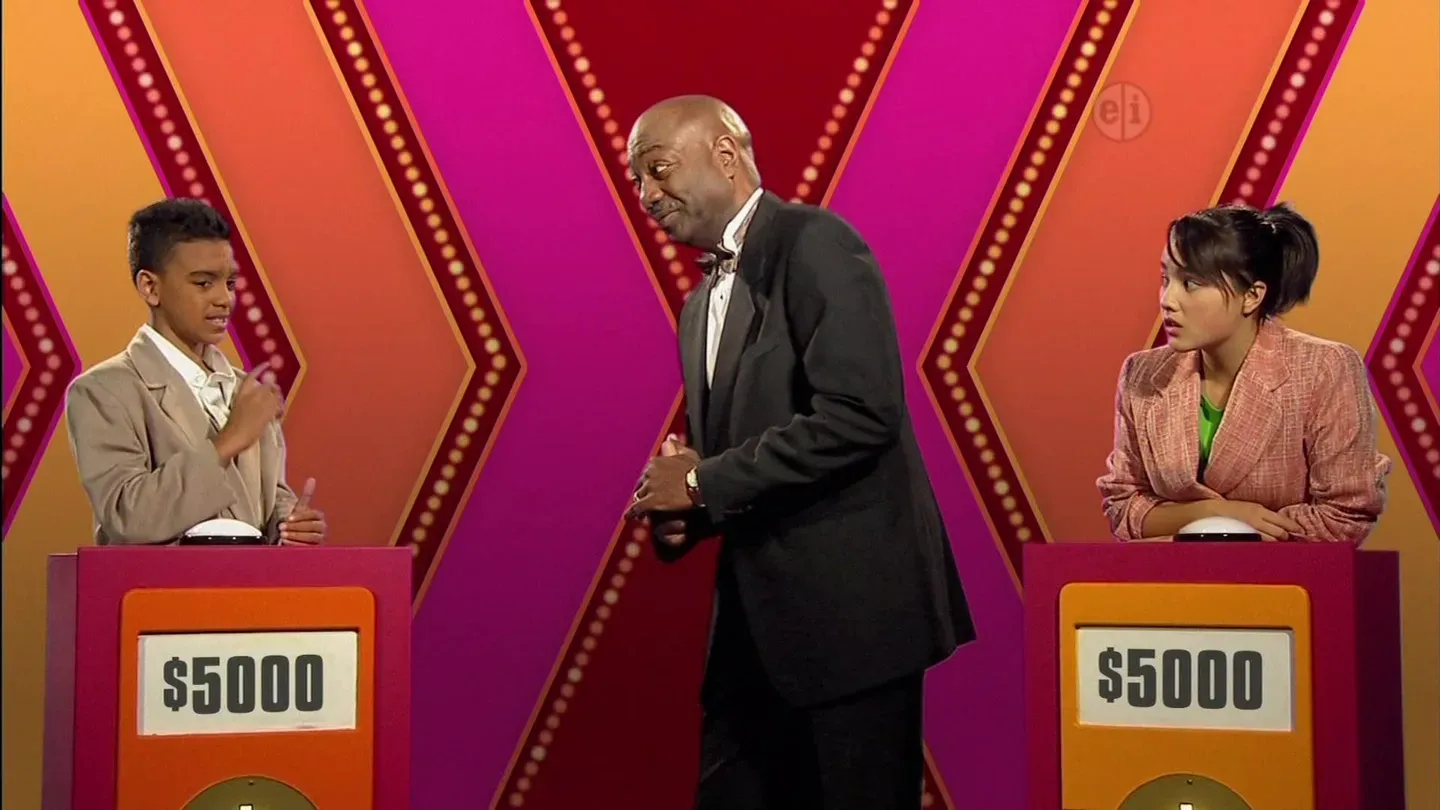

>> Hello and welcome again to Are You Interested?

the show that lets you pick your own interest rate on fabulous prizes.

Let's get started, shall we?

Eric.

Jill.

The rules of the game are simple.

We start you off with $5,000.

And there it is.

You will pick a prize, and then we'll give you a selection of interest rates to choose from.

But if you go over your $5,000 limit, you go home empty-handed.

Are you ready?

( audience cheering ) Okay.

Today's prizes are an mp3 player, a laptop computer, and a 60-inch plasma-screen TV.

What do you think, kids?

Swell, okay.

Eric, you won the coin toss, so you get to go first.

Which prize do you want?

( audience shouting suggestions ) >> Plasma TV.

>> All righty.

Eric wants the plasma-screen TV with a value of over $2,500.

Eric, here are your interest choices: A, 100 down, 20% interest over ten years; B, 1,000 down, 5% interest over five years; or C, $2,500 down.

What's the interest rate for you?

>> Uh, B... no, no, A, A!

>> Eric, is that your final answer?

>> Well, it seems like the least amount, so I'll go with it.

( buzzer ) >> Oh.

You know what that means, Eric?

You chose to pay 100 down, 20% interest over ten years.

At that interest rate, this $2,500 screen would cost you about $30,000.

You lose!

( audience cheering ) >> I would like to buy your goat on credit.

I will pay you two lizard eggs per month.

>> No, no, cash only.

>> Well, maybe you did win something.

As a matter of fact, you did-- a valuable lesson.

And we'll be right back with more of Are You Interest... >> Both of them had credit cards, which they used for things like hot dogs, video games, and fine clothes.

>> Looking good, baby.

>> Oh, sorry, that's... that's not the right... here.

>> People are definitely blown away by how young I am, especially on the investing side.

And then, you know, on the high- end listings, like this one we're in right now, it's definitely a challenge to overcome.

So I like to meet people over the phone first, when they think I'm 40 years old.

Then they meet me in person.

They're like, "Whoa, you're really young.

How do you know this much?"

Hi, I'm John Cassabellas, and I'm selling this house.

Welcome.

This is the dining room, nice and open to the view.

I'll take you over here.

You can see the kitchen.

I was kind of always an entrepreneur.

At the time, I was running a valet company, as well as a parking enforcement company.

So I kind of wanted to get into real estate the whole time.

This house is selling for 3.9 million, and you can have it for yourself if you have good credit.

When you buy a house, you need a loan, and to get a loan, you need people to trust you.

So that comes back to having a good reputation, and that's your credit score.

The banks will not loan you money if you have a bad credit score.

That is a bad reputation to have.

Yeah, your credit score is a 550?

No, I can't sell to you.

There's no way.

You've got to have good credit, or I can't sell to you.

Well, my credit kind of got boosted very quick from the get- go just because I bought a car and paid it off really fast.

So it showed really good history that way.

It looks like I don't carry debt too long and paid it off.

I own this house, too.

This house sold for 4.2 but is actually really worth about five million.

So he got a good deal for stepping in early.

The guy that bought this house bought it with good credit.

Really it's easy to get good credit.

It's very hard, once you have bad credit, to get that good credit again.

The key is never to pay late.

Definitely anybody can do this.

You know, all it takes is a high school diploma and a 60-hour course, and you can get... definitely you can get into real estate.

I love my job.

Hey, Biz Kid, make sure you keep your credit score up.

>> There are some people who's only job is to monitor your credit.

They give you a credit score, kind of like your GPA, your grade point average in school.

>> If you miss payments or you're slow to make them, it can affect your credit score.

>> And that can mean the difference between getting a loan for a car, a job, insurance; the list just keeps getting longer.

>> Hi there.

I'm doing a painting of my own personal credit history, and it's not a very happy little painting, no.

It starts out pretty good early in my life, but then as I go through the years, we get down here near the bottom, my credit score is downright lousy.

But I'll tell you what we can do to fix that.

We'll just take this, and we'll turn it like that.

Yeah.

Now when we look at my credit history, it starts out a little bit shaky, but look how good it gets as we move through the years.

Yeah.

Now it's a happy little credit history, uh-huh.

>> Ah, nice shot.

>> Add two points.

>> It's easy to score in a basketball game.

When the game's over, you can go home.

>> There's another score that follows you around, though-- your credit score.

>> Your credit score is based on... uh, uh, well, these guys can explain it.

>> There are a couple of companies out there that monitor us and how we use our credit.

They see if you pay your bills on time, how much credit you have, what you do with your credit, and they give you a score.

>> A lot of people care about your credit score, and it's not just about getting a loan either.

>> More and more these days, people have decided that the way you use your credit determines the kind of person you are.

>> What does that mean?

>> It means that if you have a bad credit score, it might prevent you from getting a job or even getting insurance.

>> And you can forget about that loan.

>> Enough of this.

Let's get on with the program.

>> So it's a very important score.

>> Exactly.

And now you know the rules of the game.

You'll know it's a game you'll play for the rest of your life.

>> Score!

>> Yes.

( bell ringing ) >> Thank you for coming in.

I thought it was time to talk about Sammy's credit report card.

I believe you know his teacher, Miss Sweepblee.

>> Has Sammy done something wrong?

>> Well, not quite yet.

I just thought we should talk before things get out of hand.

>> What do you mean?

>> Well, he's got a very high balance on his hot lunch account, and he hasn't made any payments.

>> Well, I like the corn-dog meals.

>> Oh, shh!

Oh, dear, that's not good.

>> And I understand that several of his classmates have extended him credit.

Let's see.

He owes Shari Clink four pencils.

>> He owes Pete Barry 46 pieces of notebook paper, and he's at his limit of five pink gem erasers from Cindy Shakton.

>> Well, I got to do my schoolwork.

>> Oh, shh!

So what does this mean?

>> Well, what you do with credit affects the rest of your life.

For example, in high school, you very well may get your gym shorts stolen by Frankie Tipton.

If you don't have credit, you're not going to get those back.

And with no credit, it's going to be hard for you to get together enough money to go to the prom with Sara Shlofski.

>> Sara Shlofski?

>> Sh!

So what do we do?

>> Well, the most important thing is for him to just stop using credit now and to pay the bills.

>> Both his hot lunch debt and his classmates.

>> You'll be doing that along with some extra homework, young man.

>> Fine, okay.

Can I borrow a pencil?

>> Credit.

>> Credit.

>> I am a single mother of an eight-year-old, and my daughter and I talk a lot about business actually.

I think it will be very important to teach my daughter about credit and to teach her about financial literacy.

Yeah, baby!

I'm Celia Herrara, and I own Urban Bricks Creative Design Company.

I started doing freelance graphic design about five years ago.

I started building a nice little client list and realized that I might actually be able to make some money off of it.

My business partner and I were ecstatic when we were granted $1,000 to start this business.

It was all we needed to get off the ground.

It was really what helped us take our first step.

>> Celia has worked with the MDB over the last eight years, through five loans.

She has one current loan.

Each of the previous loans she has paid off in full in a timely manner.

>> Micro Business Development, with their business by urban youth program, with their youth works program, this is really what set me on this path.

Right now we're at Cafe Karma located in Denver, Colorado.

It's the best cafe in Denver.

For Karma Cafe, I do the marketing.

I do all of their graphic design.

I do their advertising design.

I am their marketing guru.

Some of the things that I've done for them include their Web site and their take-home menus.

Doing the graphic design has been working out really great.

It's something that I love to do.

It's something that I can do for hours on end and still be inspired and still feel creative.

Micro Business Development gave us the tools, they gave us the resources we needed, and they really encouraged us, and they really promoted us to continue to do our own thing.

Welcome to the Karma Cafe.

>> Celia is an incredible sales person and marketer, and she has amazing talent.

>> My mommy's dope!

Peace!

>> It is important as a small business owner, and it is important as a person in this society in general, to be well- versed in finances and what it means to have credit, what it means to build credit, what it means to screw your credit up, to be honest.

Credit can be good, and credit can be bad.

Credit can be your friend, and credit can be your enemy.

>> Stop whatever you're doing and apply now for the Squeezya card.

The Squeezya card will bring some real changes to your life.

>> Squeezya talked about a low interest rate on their ad, but now my rate's a lot higher.

>> Squeezya sold my name to other companies, so now they can sell me more stuff.

>> Squeezya said it was okay if I missed a payment or two, but that's because they just heap on huge charges.

>> Squeezya calculated my minimum payments to ensure I'll be paying them interest for many, many years.

>> Sure, Squeezya wants to help you with all the everyday things that matter to you, like buying clothes or, say, getting gas for your car so you can drive to school.

But more importantly, Squeezya wants you to be in debt to them, deeply in debt, and to pay them lots of interest.

So call Squeezya today.

You won't believe the difference it'll make in your life.

( phone ringing ) Hello, Squeezya.

Yeah, no, no, you should get several of them.

Yes, the more the better.

>> It was very easy to get a credit card.

Filled out my name, address, signed it at the bottom, and that's all it took.

Hi, I'm David Mendoza, and I'm a victim of my own credit.

A victim of my own credit.

I got my first credit card when I was 18 years old, just turned 18, freshman year in college.

I used it responsibly.

I had an $1,100 credit limit, never went over the limit.

I was very close to it, but never over it.

Then I lost my job, and I was unemployed for six months, and I went over the limit.

I was charged in over-the-limit fees to the extent that my $1,100 limit actually went up to $2,900.

I started with an $1,100 debt limit.

Because of my unemployment, I went up to $2,900.

And I've paid $60 a month since then for six years.

Calculating wrong-- let me start over.

I've paid $4,300.

My current balance is about $1,600.

And so that's $2,700 in finance charges and fees that I've paid.

So that's quite a bit of money that has only gone to the credit card company's pocket.

If I was 18 and had to do it all over again, this is what I would do.

When you see these envelopes come in the mail, this is what you should do as well.

>> Captain's log, star date... just before dinnertime.

We're negotiating with a salesman for a new shuttle craft.

>> Capitalist Kirk, message incoming from Ted's Shuttle Shack.

>> On screen.

>> Hey, so I got your credit report back, and it's not so good.

It says here that you want the XG model.

Well, with good credit, that would run you about 150 parsecs a month, but with your credit, that's going to be more like 600.

>> What?

( alarming blaring ) That's four times the payments.

>> Not going to happen, is it?

Nope, no, not for you.

>> Aiming photon torpedoes at the coordinates, sir.

>> No, Checkbook, that's not the way.

Stock, analysis.

>> Misusing credit is highly illogical, Captain.

Apparently there are credit issues in your past, Captain.

>> I want to know what these issues are, and I want to deal with them now.

>> Sir, this is addressed to you.

( glass shattering ) >> About my credit score.

Let's see, let's see.

"We are withholding your credit card because you are six months behind on payments."

>> Logic would indicate that you should pay your bills on time in the future, Captain.

>> Checkbook, aim photon torpedoes at the Star Fleet Credit Card Company.

>> Captain, that course is not logical.

>> It's time for the viewer submitted video.

>> Bills, bills, bills, bills.

What, a credit card?

Yes!

Cool.

Whoo-hoo, yeah!

I'll pay for that with my credit card-- credit card.

♪ Ahh, Credzilla is attacking the city ♪ Causing destruction and it's a pity ♪ Chaos and overall mayhem financial ruin and overall devastation ♪ And if you keep your wallet in your overalls ♪ Credzilla will be sure to shake the walls ♪ With interest rates finance charges and fees ♪ Mother always said credit cards don't grow on trees ♪ The money's not free I got to pay it back ♪ Or else Credzilla will attack ♪ It adds up it'll take a toll ♪ Last month I bought a brand-new video game console ♪ And I put it on my credit card ♪ And now my finances are shattered in a million shards ♪ And my mailbox is filled with letters from billers ♪ Attack of the legendary Credzilla!

♪ >> ♪ Oh, no, it's Credzilla oh, no, it's Credzilla ♪ Oh, no oh, no ♪ Oh, no, it's Credzilla!

♪ >> Brian, you've got to keep track of your credit!

>> Ooh, I'm losing money!

Where's it going?

>> Brian, you've got to learn to pay your credit bills on time, or you'll never get ahead!

>> No more losing money to late fees.

How do you know so much about credit?

>> Credit-schmedit!

It's easy when you're Capitalist Peg.

>> And now it's time for today's Biz Kids Biz Quiz!

The best way to use credit is...

If you answered A, I've got a high-interest card for you.

If you answered B and/or C, you're a Biz Kid!

>> The adrenaline is starting to flow.

I'm going to sing some songs to these kids about credit.

You know, you ever heard that expression, "Hey man, give me some credit"?

Let me tell you something.

Nobody has to give you any credit.

You have to earn credit!

And the way you get credit is by having a good credit history.

That's how you get more of it, okay?

Because if you don't have a good credit history, it is going to come up and bite you on the... ( applause ) Well, I'll tell you where it's going to bite you later, because I got to go on right now, because it is show time!

>> Whoa, dude, not yet.

>> Okay, I guess they introduced somebody else.

Let's see, where was I?

Oh, yeah, it's going to bite you.

>> I told you Biz... >> Hey, hey, credit!

>> Having people laugh and smile is awesome.

I couldn't work at a job where people are all depressed and quiet.

I mean, I go to a party, I want kids to scream.

I want them to shout.

I want them to be kids-- relax, have fun.

My name is James Smith, I'm 18, and I'm a Biz Kid.

The name of my company is B-Loons Army.

>> I know James because he's been one of our most loyal and consistent clients.

>> MDB is Micro Business Development.

They help small businesses and youth entrepreneurs build capital and help start their businesses.

When I first started, my inventory was a simple two helium tanks and a bunch of balloons sitting in a shed.

Since then, I've purchased a 24- foot rock wall, my two inflatables, my bounce house, and my slide.

The newest equipment to my operation this year are my two miniature ponies.

Put your foot... put your foot in the stirrup.

>> I think the first kookiest idea that I had to deal with was actually these guys.

I said, "What are you going to do with these ponies, James?"

And he said, "Let kids ride them; it's going to be great!"

>> A lot of times you go into a bank looking for a loan, they're going to look at you and say, "You're just a kid.

How can you pay it back?

You're a kid."

That's why I deal solely through MDB.

I came to them, said, "This is what my plan is, this is what I want to do."

And they said, "Well, we believe in you; we're going to give you all the resources we can in order for you to grow your business."

>> I think the thing about James is that he has a good idea of what he wants to offer, but he's always kind of altering it and changing it to, like, kind of keep up with kind of the needs of the people he's trying to serve.

So he does a good job.

>> It's important to pay my loans back-- a lot for me, just because if I don't, that's my word, and I'm throwing my word away.

Without that credit, I mean, I wouldn't be near where I'm at.

My future, hopefully by the time I'm 21, I'll be a millionaire.

I'm still working on that one.

>> This kid is quite a Biz Kid.

>> The hare was swift and speedy when it came to paying his credit card bills.

The tortoise was slow and almost always late.

The hare was rewarded with a higher credit score, a lower interest rate, and perks like a Hawaiian vacation.

The tortoise got slapped with a huge late fee and had all of his stuff repossessed.

The moral of the story is be like the hare; pay your bills on time.

>> And now the Biz Kids are taking it to the street to ask do you use credit?

>> Do you have a credit card?

This is my "Are we rolling?

I don't know."

>> We're rolling.

>> We are rolling?

Do you have a credit card?

>> I don't have a credit card.

>> I have one, but I never use it.

>> I use cash.

>> Do any of you guys have credit cards?

>> No.

>> No.

>> I have one that's over the limit, and so I don't use it any longer.

>> I do not have a credit card.

>> Cash, I always use cash.

>> Yes, I do have a credit card.

>> A credit card you pay on credit.

So if you don't pay on time, you pay interest.

>> Why don't you use it?

>> Because I don't trust myself to pay it on time.

>> Do you have a credit card?

>> I do not.

>> A credit card you're running a line of credit that you got to pay off later.

>> I don't want to get into debt.

>> I am debt free.

>> Credit.

>> Credit.

>> Cash.

>> Credit.

>> Cash.

>> So there you have it.

Spend wisely and... >> Be a Biz Kid!

>> Cash and credit, you have to know about both so that they don't get you into trouble.

>> Credit's like a family pet, a loyal friend that's there when you need it.

But if you don't take care of it, it could turn on you.

( growling ) >> It's kind of like trust: once you lose it, it's hard to get it back.

So be careful with your cash.

>> And be sure to give credit the credit it deser... >> If you don't keep your credit score up, you're going to deal with me, and you don't want to do that.

>> Okay, so here's what credit is all about.

Have you saved up enough money to buy that car?

>> Why are you laughing?

>> Shake it out, shake it out.

Got it.

>> Another big show, another big show.

Ah, that was a good-looking audience out there, except for that one kid, yeah.

You know what?

People ask me all the time, "Hey, Kaching, what's your credit score?"

I'm not ashamed of it.

I'll tell you what it is.

It's 86 to 83.

That's a pretty close score.

Yeah.

I'm happy with that.

>> Hey, do you know a successful business?

>> Maybe you're a Biz Kid.

If so, we want to hear about it.

Got some video?

We want to see it.

>> So check out bizkids.com to find out all the details, and maybe we'll see you on the show.

>> Yeah, like us.

>> What's so special about us?

>> We're on TV.

>> Does make us pretty special.

>> Yeah.

>> Just check out the Web site, because if you're a Biz Kid, we want to hear from you.

>> Production funding and educational outreach for Biz Kids is provided by a coalition of America's credit unions, where people are worth more than money.

A complete list of individual credit union funders is available at wxxi.org.

>> Every day, America's credit unions help members with their financial needs and with programs like Invest in America.

It's only fitting that credit unions support Biz Kids because financial education is what we do.

Learn more at lovemycreditunion.org.

Captioned by Media Access Group at WGBH access.wgbh.org

- Home and How To

Hit the road in a classic car for a tour through Great Britain with two antiques experts.

Support for PBS provided by:

Biz Kid$ is presented by your local public television station.

Distributed nationally by American Public Television